How would you characterise the current economic outlook in Mexico?

The economic outlook in Mexico for 2016 and 2017 is stable and well positioned compared to other emerging markets. The general consensus is that growth will be around 2.5% and 2.1% for 2016 and 2017 respectively; however those figures could fall on recent expenditure cuts by the Ministry of Finance.

Low inflation expectations have produced an increase in real wages, which along credit expansion and remittances have pushed consumer demand. This is supporting the economy, and is partially offsetting the effects of weaker exports and fiscal tightening.

Consumption performance will remain solid, similarly to what we have previously seen and particularly in relation to same store sales and the retail dynamism in the economy. However these numbers might normalise looking ahead. Job creation has been another positive factor for the Mexican economy, but foreign investment needs to accelerate to push economic growth at higher levels.

The main risks for the Mexican economy at present are how the adjustment in its balance of payments deficit will be worked out and the outcome of the US presidential elections.

In what sectors are you seeing the most potential in terms of investment opportunities? What are some of the driving factors in play here?

The sectors with the highest investment potential are infrastructure and energy. With the lack of public investment in the infrastructure sector, private investment has a lot of opportunities to harvest great deals on toll roads, renewable energy and water solutions as well as others.

Some of the key factors in these sectors are the changes that the country is facing; positive demographics, a growing middle class and overall population growth mean that the needs for increased infrastructure developments are self-evident.

Furthermore, the trends in the energy sector such as the renewable energy and oil auctions (farm-outs) from Pemex can unlock potential not only for E&P companies but also for other related services companies (along the whole chain).

How would you compare Mexican investment opportunities to others in the Latin American asset universe?

Latin America is changing from what we experienced six years ago. Although the region is very different from some developed markets and even other EM economies, politics in Latin America is heading away from the populist governments that were prevalent in the past, particularly over the last decade.

In Brazil, Dilma Rousseff has been removed from power and the new administration has already begun to change the direction of the country’s economic policy. In Peru, a former World Bank economist, Pedro Pablo Kuczynski has won the presidential elections on June 5.

In Argentina, Mauricio Macri won the presidential elections, which is a huge change in the country’s history since it is the first time that a right-wing party has won the presidency by electoral means. As a result of this, President Correa in Ecuador decided not to run for re-election, and Evo Morales lost a referendum that would allow him to be re-elected in Bolivia. In Mexico, the right-wing party PAN emerged as the main winner of the elections of governors in Mexico.

This is in contrast to populist movements elsewhere. There is growing popular support for counter-movements across France, where the populist right-wing party led by Marine Le Pen increased its popularity ahead for the presidential elections next year.

In Germany, a right-wing and anti-immigration party known as Alternative für Deutschland achieved good results in the last state elections and in Italy, an anti-establishment party, Movimento 5 Stelle, won elections in Rome and Turin.

Despite the decline in populism across Latin America, which is positive for investors, Mexican demographics and the size of the country’s markets mean that investment opportunities are competitive than in other Latin American countries.

For example, the investment environment regarding the oil industry in countries such as Colombia and Brazil is less favourable than it is in Mexico. Concerning infrastructure, Mexico has a development plan lead by the government to construct airports, toll roads and other types of projects in which private investment can partake. Unlike in other countries in Latin America, the Mexican government’s involvement is key to developing and executing plans.

CKDs and Fibras are likely to be the best vehicles to utilise for involvement in such investment opportunities. Although portfolio flows could focus more on economies such as Brazil, Colombia and Argentina, which are offering higher yield and cheaper equity valuations, Mexican fixed income still offers appealing risk adjusted returns and corporates can still deliver decent earnings growth.

In this environment, Mexico could be the safe heaven or low beta player where investors would like to remain. Regarding FDI, Mexico is likely to receive an increase in flows over its peers due to its positive balance between predictability and attractiveness.

Are current corporate leverage levels a concern?

Not at all, we think that companies are below leverage levels since they have not been investing much in M&A or CAPEX. The levels of net debt to EBITDA within the market are below 3 (at 2.75), which is only slightly above the 2.25 ratio that we have seen historically.

Mexico’s current net debt to EBITDA ratio compares favorably with other Latin American countries, such as Brazil, at 3 and Chile, at 4.

Company balance sheets are healthy, and many entities have solid cash balances. The M&A deals that we have witnessed in the markets have been financed either through cash or in stocks.

Another positive factor for having low leverage within the corporate space is that payout ratio in Mexico is still low, so we don’t see a problem regarding leverage. Companies have also been disciplined in terms of improving their balance sheets, with cost cutting programs and operational efficiencies.

With growth seemingly slowing in Mexico, what sectors do you think are most vulnerable?

The challenge for the corporate sector will come in the second half of 2016. The key elements in the 1Q and 2Q results were cost cutting measures and improvements in the efficiency of the balance sheets of many corporates. We think that this is almost complete, so top line growth will be needed in order to maintain a growth in earnings. We believe that companies that are able to successfully increase their prices to consumers as well as maintain a growth in sales will continue to report above expectations. Companies related to the travel sector, and those with an exposure to US dollars will also deliver good results. We do not foresee any negative effects.

If consumption normalises, we could see a small slowdown in terms of growth within such sectors, but it is not something to worry about. However, it would be prudent to be aware of the manufacturing sector in Mexico, as well as the influence of external factors, as if manufacturing in the US decelerates significantly, we could face a recession and an economic slowdown like we saw in the first 2 months of this year.

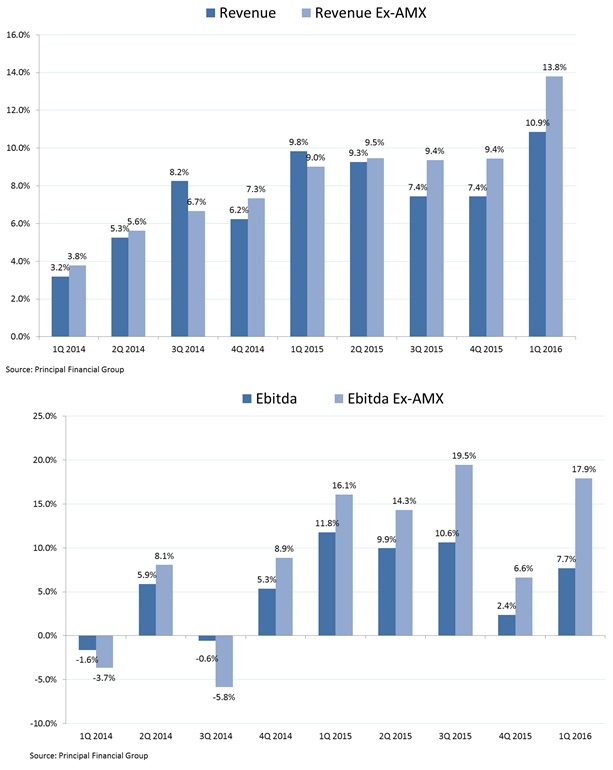

For the first time in many years we saw a favourable quarterly reports season in Mexico for 1Q16. In the companies we follow, revenue growth was 11% and EBITDA growth was 8% year-on-year. Excluding the worst performer (AMX), the numbers were 13.7% and 17.8% respectively.

The aforementioned consumer companies and sector were the best performing, with revenues growing almost 19%, and EBITDA at almost 22%.

The results include the impact of negative currency effects, so overall the numbers are good. For the second quarter we also expect good results in cyclical and consumer companies benefiting from the positive economic environment and above data.

Mexico recently hiked interest rates, slightly faster than some economists expected. To what extent has this influenced your investment outlook on exporters?

Not much, as we have a positive outlook for the industry for the long-run. As long-term investors, we take into account this type of action in our investment process, and this specific move did not change our investment thesis.

Macroeconomic events such as fears of a recession or a global slowdown in economic activity have a more significant impact on our view of exporters. We saw the rate hike as part of a disciplined and cautious move by the Ministry of Finance and the Central Bank.