Background

Background

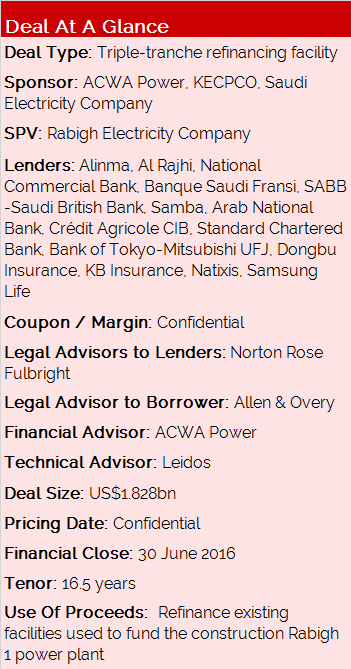

ACWA Power sought to refinance existing debt related to its 1204 MW Rabigh1 power plant. Construction of the plan began in 2009 and it reached commercial operation date in April 2013.

Given that the construction risk and the early operation risk have been successfully eliminated, the sponsors decided to refinance its long-term non-recourse facilities to reduce the cost of financing and use the balance tail available within the PPA tenor. This would allow the offtaker to receive a discount on the tariff for the remainder of the PPA term.

Transaction Breakdown

The refinancing facility was split into three portions.

An uncovered conventional debt consisting of US$300mn consisting of fixed and LIBOR-linked floating rate tranches was contributed by Samsung Life, Dongbu Insurance, KB Insurance, and international commercial banks including Natixis, MUFG, Crédit Agricole -CIB and Standard Chartered Bank.

A Saudi riyal-denominated Wakal Ijara tranche in excess of SAR3.2bn was provided by Alinma Bank and Al Rajhi Bank.

Finally, a Saudi riyal-denominated Procurement tranche in excess of SAR2.4bn provided by the National Commercial Bank, Banque Saudi Fransi, Arab National Bank, Samba Financial Group and The Saudi British Bank (SABB).

The total funding package has an average tenor of 16.5 years.

The deal, a milestone for ACWA Power and the first to be concluded under a new IPP framework in Saudi Arabia, helped unlock a significant new pool of liquidity for the company, and is considered to be the largest IPP refinancing deal in MENA to date.

“It is heartening to see the Rabigh 1 IPP project, which was the first IPP project in Kingdom of Saudi Arabia under the new framework, to go from original financial close, construction, three years of smooth operation and now successful refinancing,” said Thamer Al Sharhan, Chairman of Rabigh Electricity Company. “This demonstrates the success of the IPP model in the Kingdom and shows how proactive financial management can improve the economics for all parties concerned.”

“The refinancing of Rabigh 1 IPP project is an important milestone for the Project and its shareholders. That this has been achieved not only in a challenging and dynamic market but also has introduced a significant new pool of liquidity to the infrastructure sector adds to the significance of the achievement,” added Rajit Nanda, Director of Rabigh Electricity Company, and Chief Investment Officer of ACWA Power.