Why the demand-side factors becoming more influential than supply-side factors: In commodities, demand side effects tend to lag. If you get big orders to get copper motors, which you won’t deliver until at least six months later, then that means you need to buy a lot of copper and use a lot of electricity to manufacture them, which is the basic reason for the connection.

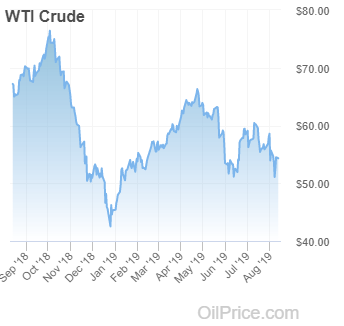

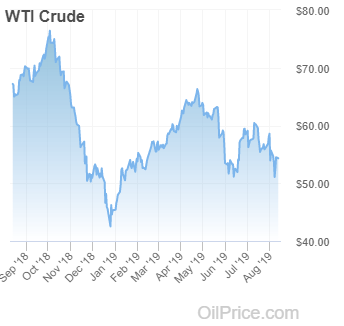

On China: That is why China is such a big factor. We are big believers in following patterns in global PMI (purchasing managers’ index) data, and we have seen trends in commodities and oil, especially, which is highly correlated to Chinese PMI. If the one-month reading is above the 3-month moving average, then we anticipate oil to go up in the next six months 70% of the time. Vice versa, if one-month is below the 3-month average, oil is likely to drop.

On China: That is why China is such a big factor. We are big believers in following patterns in global PMI (purchasing managers’ index) data, and we have seen trends in commodities and oil, especially, which is highly correlated to Chinese PMI. If the one-month reading is above the 3-month moving average, then we anticipate oil to go up in the next six months 70% of the time. Vice versa, if one-month is below the 3-month average, oil is likely to drop.

So, when global PMI stays positive, the probability of a commodity rally to last 9 months or longer increases. These are some of the tectonic shifts we have seen in global markets. The problem is that while easing during expansion pretty much guarantees a further rally in stocks, PMI tends to rise only in about 6 out of 10 cases. In essence, the PMI figures are a leading indicator highly correlated to commodities, while the stock market is an indicator correlated to earnings.

On US fracking: In hydrocarbons, frackers have become a huge factor on the supply side – US fracking technology has improved so much, that actually, recently, they have been pumping some of the natural gas back into Texas on the back of strong supplies.

Alternative energy is another big trend. In fact, renewable sources such as turbines are increasingly being integrated into or combined with extraction of natural gas and fracking. This is driving down the cost of electricity, and therefore the costs of exploration. That keeps oil range-bound; every time oil rallies beyond the USD80 per-barrel level, frackers ramp up production and it drops again.

The current price level on gas in particular is still deflated, so for now, fracking activity has slowed, unlike earlier this year. But few other countries have really embraced this technological advancement, which has created a natural neutralizer to oil prices shooting up above USD100 per barrel, which it probably never will again.

More than 30 years ago, Frank bought a controlling interest in U.S. Global Investors and has led the company, as CEO and chief investment officer, to become a go-to destination for investors seeking exposure to gold, natural resources, emerging markets and more. In 2006, Frank was selected mining fund manager of the year by the Mining Journal, and in 2011, he was named a U.S. Metals and Mining “TopGun” by Brendan Wood International. In 2016, he and portfolio manager Ralph Aldis received the award for Best Americas Based Fund Manager from the Mining Journal.

Frank is known as one of the world’s leading experts on gold finance and investing. He is the co-author of The Goldwatcher: Demystifying Gold Investing. His award-winning CEO blog, Frank Talk, is one of the very first to appear in the world of finance. More than 30,000 curious investors subscribe to his weekly commentary in the highly popular Investor Alert newsletter, read in over 180 countries and territories. His work regularly appears in Forbes, Seeking Alpha, Wall Street Journal’s “Experts Corner,” Kitco, GoldSeek and much more.

Frank is a true global citizen. A much-sought after keynote speaker at national and international investment conferences, he’s spoken at the Investing in African Mining Indaba conference, the Denver Gold Group’s European Gold Forum and numerous Money Show and Mining Journal events.

His frequent travels, in fact, helped inspire him to launch the U.S. Global Jets ETF (JETS) in 2015, still the only ETF on the market that focuses on the global airline sector. He followed this up, in 2017, with the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU), which provides investors to companies engaged in the production of precious metals, with an emphasis on the royalty and streaming model.

Besides his writing and speaking, Frank is a regular commentator on financial television networks such as CNBC, BNN and FOX Business. His thoughts on the gold industry can be regularly seen on Kitco News, in collaboration with TheStreet.com.

Always forward-looking, Frank led U.S. Global Investors into the blockchain and cryptocurrency space by making a strategic investment in HIVE Blockchain Technologies, the world’s first publicly-traded company engaged in the mining of virgin digital coins. Frank was appointed non-executive Chairman of the Board, and he now leads the HIVE board of directors, contributing to the company’s vision and overall strategy.

When Frank isn’t working he enjoys spending time with his family, participating in long-distance running – including full and half marathons – reading, and exploring the local art community, whether that’s in San Antonio or in Toronto, the two cities where he splits most of his time.

On China: That is why China is such a big factor. We are big believers in following patterns in global PMI (purchasing managers’ index) data, and we have seen trends in commodities and oil, especially, which is highly correlated to Chinese PMI. If the one-month reading is above the 3-month moving average, then we anticipate oil to go up in the next six months 70% of the time. Vice versa, if one-month is below the 3-month average, oil is likely to drop.

On China: That is why China is such a big factor. We are big believers in following patterns in global PMI (purchasing managers’ index) data, and we have seen trends in commodities and oil, especially, which is highly correlated to Chinese PMI. If the one-month reading is above the 3-month moving average, then we anticipate oil to go up in the next six months 70% of the time. Vice versa, if one-month is below the 3-month average, oil is likely to drop.