An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations.

Each score is determined by a weighted compilation of fifteen economic and political indicators. These include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance.

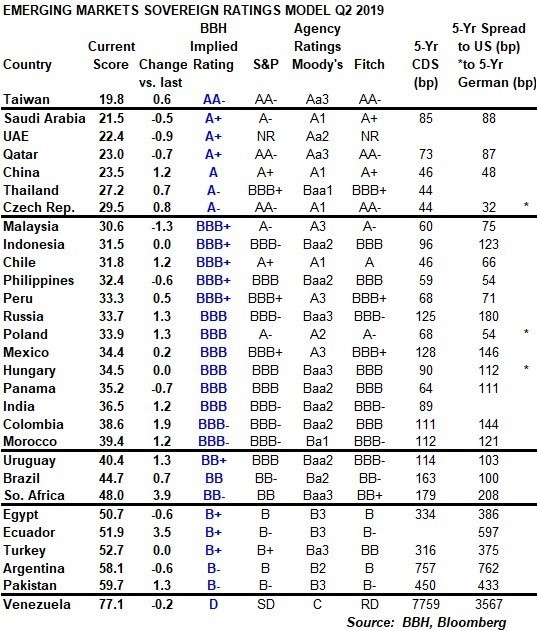

These scores translate into a BBH implied rating that is meant to reflect the accepted rating methodology used by the major agencies. We find that our model is very useful in predicting rating changes by the major agencies. The total number of Emerging Market countries covered by our model now stands at 30, reflecting our decision to move Hong Kong, Israel, and Singapore to our DM universe as per MSCI Developed Market classifications.

Emerging Markets Rating Summary

There have been 6 EM rating actions so far in 2019. There were 3 positive actions and 3 negative actions. For 2018, positive actions made up 50% of the total moves and so the trend so far this year steady. In 2017, positive actions made up 40% of the total moves, up from 29% in 2016. Clearly, the moves seen so far in 2018 represent further improvement over the previous years and suggest that EM ratings continue to improve after several years of downward momentum.

Each agency has made one positive move so far this year. Both S&P and Fitch upgraded Hungary a notch to BBB with stable outlook, while Moody’s upgraded Russia a notch to Baa3 with stable outlook.

S&P has been the most negative this year with two moves. It downgraded Pakistan a notch to B- with stable outlook and moved the outlook on Mexico’s BBB+ rating from stable to negative. Elsewhere, Fitch moved the outlook on Ecuador’s B- rating from stable to negative.

Emerging Market Ratings Outlook

Latin America

Argentina entered our EM model universe at an implied rating of B+/B1/B+ last year but has since dropped two notches before stabilizing at B-/B3/B-. Downgrade risk is seen for all three actual ratings of B/B2/B.

Brazil’s implied rating was steady at BB/Ba2/BB. Actual BB-/Ba2/BB- ratings are likely to be kept steady until the incoming Bolsonaro government reveals its intentions and ability to enact pension and other structural reforms.

Chile’s implied rating was steady at BBB+/Baa1/BBB+. The fall in copper prices has taken a toll and actual ratings of A+/A1/A are still facing significant downgrade risk. Ecuador’s implied rating fell a notch to B+/B1/B+, reversing last quarter’s rise and moving it closer to actual ratings of B-/B3/B-.

Colombia’s implied rating was steady at BBB-/Baa3/BBB- after falling a notch last quarter. This suggests S&P’s downgrade to BBB- may not have been the last of the downgrades. Moody’s and Fitch’s ratings still appear too high at Baa2 and BBB, respectively.

Mexico’s implied rating remained steady at BBB/Baa2/BBB. Actual ratings of BBB+/A3/BBB+ are still facing downgrade risks, but much will depend on the policies of incoming President Andres Manuel Lopez Obrador. The recent Mexico City airport fiasco is not a good sign, however.

Peru’s implied rating was steady at BBB+/Baa1/BBB+. As a major copper exporter, the fall in prices fed through into weaker fundamentals. However, the outlook has improved and actual ratings of BBB+/A3/BBB+ appear to be largely on target.

Uruguay’s implied rating fell a notch to BB+/Ba1/BB+, the second straight quarterly drop. This suggests that actual ratings of BBB/Baa2/BBB- are subject to increased downgrade risk. Elsewhere, Panama’s implied rating was steady and puts it right at actual ratings of BBB/Baa2/BBB.

Venezuela’s implied rating remained steady at D and its score has stabilized in recent quarters. While the recent recovery in oil prices will help most oil producers, we think years (decades?) of economic mismanagement have pushed Venezuela to the brink of default and ever deepening social upheaval.

Asia

China’s implied rating fell a notch to A/A2/A. The slowdown is taking a toll on the economy and we see growing downgrade risks to actual ratings of A+/A1/A+. Elsewhere, Taiwan’s implied rating was steady at AA-/Aa3/AA- and keeps it right at its actual ratings.

India’s implied rating was steady at BBB/Baa2/BBB. Several quarters ago, India was facing downgrade risks to its BBB-/Baa2/BBB- ratings. Now, we are seeing some modest upgrade potential. Elsewhere, Indonesia’s implied rating was steady at BBB+/Baa1/BBB+. Actual ratings of BBB-/Baa2/BBB are still enjoying some upgrade potential.

Malaysia’s implied rating was steady at BBB+/Baa1/BBB+. As such, modest downgrade risks to actual ratings of A-/A3/A- remain on the table. Thailand’s implied rating fell a notch to A-/A3/A-, reversing last quarter’s gain. Still, there remains upgrade potential for actual ratings of BBB+/Baa1/BBB+.

The Philippines’ implied rating was steady at BBB+/Baa1/BBB+. There is still some modest upgrade potential to actual ratings of BBB/Baa2/BBB. Pakistan’s implied rating was steady at B-/B3/B-, suggesting actual ratings of B-/B3/B- are right on target.

EMEA

The Czech Republic’s implied rating was steady at A-/A3/A- after falling two notches last year. As such, we continue to see downgrade risk to its AA-/A1/AA- actual ratings. Hungary’s implied rating was steady at BBB/Baa2/BBB after rising a notch last quarter and suggests actual ratings of BBB/Baa3/BBB are largely on target.

Poland’s implied rating fell a notch to BBB/Baa2/BBB, reversing last quarter’s rise. Our model suggests greater downgrade risks to actual ratings of A-/A2/A-. Turkey’s implied rating was steady at B+/B1/B+ after rising a notch last quarter. We still think Turkey faces very strong downgrade risks to its B+/Ba3/BB ratings.

Russia’s implied rating fell a notch to BBB/Baa2/BBB, reversing last quarter’s rise. Higher oil prices are boosting Russia’s numbers and offsetting some of the impact of sanctions. As such, there is still upgrade potential for actual ratings of BBB-/Baa3/BBB-

South Africa’s implied rating fell a notch to BB-/Ba3/BB-. Moody’s and Fitch’s ratings of Baa3 and BB+, respectively, are seeing heightened downgrade risk. Loss of investment grade from Moody’s would lead to ejection from WGBI. Even S&P’s BB rating appears too high now.

Turkey’s implied rating was steady at B+/B1/B+ after rising a notch last quarter. We still think Turkey faces very strong downgrade risks to its B+/Ba3/BB ratings.

Qatar’s implied rating rose a notch to A+/A1/A+. This comes after a two-notch improvement last quarter. However, Qatar still faces some downgrade risks to actual ratings of AA-/Aa3/AA-. The UAE’s implied rating was steady at A+/A1/A+, which still suggests downgrade risk to its lone Aa2 rating from Moody’s.

Saudi Arabia entered our EM model universe at A/A2/A last year and then improved a notch last quarter. Its implied rating was steady at A+/A1/A+ this quarter. This still suggests upgrade potential for S&P’s A- rating, while Moody’s A1 and Fitch’s A+ ratings appear to be on target.

Elsewhere, Egypt’s implied rating was steady at B+/B1/B+. Actual ratings of B/B3/B are still enjoying some upgrade potential. Morocco’s implied rating was steady at BBB-/Baa3/BBB-, and so actual ratings of BBB-/Ba1/BBB- remain largely on target.

Conclusions

The heavy weighting of negative moves in EM in recent years continues to ease as we move into 2019. Low commodity prices had a negative impact on the commodity exporting countries in recent years, but those ratings should improve as commodity prices have largely recovered.

We continue to warn investors that EM fundamentals will still diverge across countries. The investment climate remains challenging, with fundamentals remaining the most important factor for global investors to consider.