Background

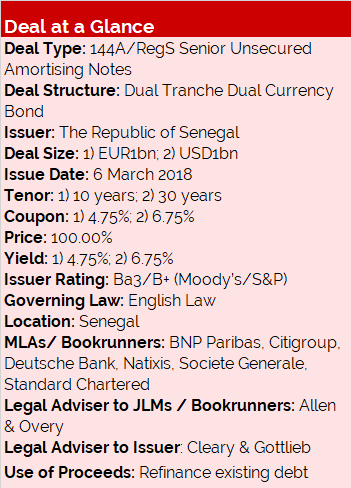

Following a USD500mn 10-year benchmark set in 2014 and a USD1.1bn 16-year Eurobond issued last year, the Republic of Senegal was looking to refinance some of its existing debt and extend its overall debt maturity with a new dual-currency Eurobond.

In March 2018, it successfully issued new notes in conjunction with a tender offer in regards to its USD500m 8.75% 2021s, upsizing the tender cap to USD200mn, the maximum amount permitted by the country’s regulators.

Transaction Breakdown

The initial tender offer for the USD500mn 8.75% 2021 notes had a fixed price with a tender premium of around 0.5%/16bp over pre-launch levels (initially capped at USD150mn), as well as offering investors a priority allocation into the new USD tranche.

Ultimately, a total of USD350.5mn were tendered, representing a success rate of 70% – one of the highest hit rates seen in recent sovereign liability management transactions.

Moreover, 75% of the tendered amount was submitted using allocation codes, reflecting the strong investor desire to roll over their holdings into the concurrent new issue. As a result of the high take-up, the Republic upsized the tender cap to USD200mn.

On 26 February, a global roadshow for a dual-tranche 144A/RegS EUR 10-year & USD 30-year benchmark bond was announced, with the Senegalese delegation meeting over 100 investors in New York, Boston, London, Zurich, Frankfurt and Paris over a period of 4 days.

On the back of those meetings and positive investor feedback, the issuer released initial price thoughts of 5.125-5.250% and 7.125-7.250% for the EUR and USD tranches respectively at London open on 6 March.

It then issued guidance of 4.875-5.00% and 6.875-7.00% respectively at NY open, and, seeing the orderbooks swell to EUR4.5bn (>250 accounts) and USD 3.7bn (190 accounts), eventually managed to set final pricing at 4.75% and 6.75% respectively, representing a tightening from IPTs of a full 50bp.

The deal was a milestone for Senegal, marking its largest ever international issuance, and first ever EURO-denominated tranche. At 30-years, the US tranche was the country’s longest tenor issuance to date and achieved the tightest yield for a Sub-Saharan sovereign (ex. South Africa) at the 30-year part of the curve.

By geography, 43% of the EUR notes were placed with US accounts (49% of the USD tranche), 28% went to the UK (36% of USD), 19% - to other European countries (13% of USD) and remaining 2% was distributed around other parts of the world (1% of USD). 1% of the USD tranche also went to Germany.

By geography, fund managers snapped up 89% of EUR and USD tranches, 6% of EUR and 3% of USD went to banks and private banks, 5% (EUR) and 7% (USD) to insurance and pension funds, with the remaining 0.4% and 0.3%, respectively, purchased by other types of investors.