Background:

Background:

In order to make its financial system truly competitive, India for a while has been looking to establish a path for its banks to offer offshore investment instruments at reasonable pricing.

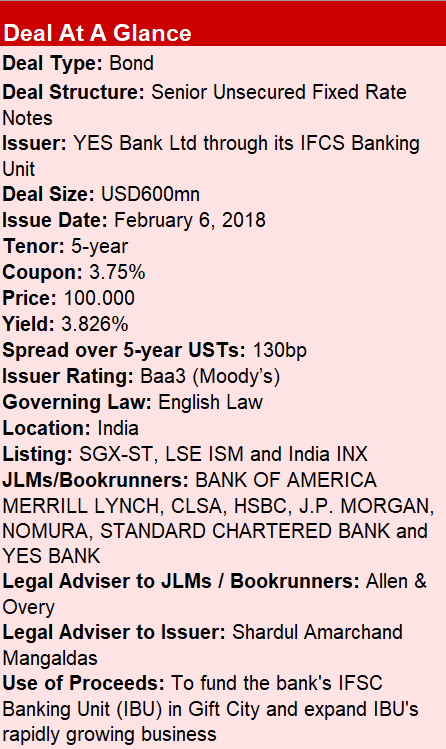

In February 2018, one of India’s largest private lenders launched its USD1bn MTN programme with a USD600mn bond issue that became the first to be listed on the country’s first international exchange and opened the gate for more listings to follow.

Transaction Breakdown

With the rapidly growing books of the GIFT branch, the bank required to diversify its funding sources at optimal pricing and it decided to do so by tapping the international bond market. It decided to come to market with a benchmark-sized transaction that was consistent with the need for longer dated liability book to match the asset profile in the branch.

Following a robust marketing campaign in key geographies – Singapore, Hongkong and London – and strong investor feedback, with investor concerns, focussed mainly around the bank’s growth strategy, capitalisation plans and use of proceeds successfully alleviated the deal was launched with IPTs of T+150.

The issuance received an overwhelming response from international investors as it was oversubscribed by more than 1.83 times from over 90 accounts, with the Initial pricing guidance of 150bp spread over the 5-year USTs tightening to 130bp – the tightest spread over USTs achieved by an Indian bank in their debut USD trade since the global financial crisis.

Notably, the deal was launched in spite of potential headwinds on account of the impending FOMC meeting and announcement of the Indian Union Budget.

The issuance was well-diversified across geographies, with the final allocation seeing 58% participation from Asia, 41% from EMEA and 1% from offshore US. By type, 46% of the notes were placed with asset managers, 38% with banks, 11% with insurance companies and 5% went to private banks.

This was the first international public bond issuance by a new generation Indian private sector bank and also the first by any entity based in GIFT City. It was also the largest debut issuance by an Indian Bank and takes local lenders to a new level of cost-efficiency.

According to S Ravi, the Chairman of BSE, the placement “will increase the momentum of growth and would attract the best of the global investors to consider IFSC in India to invest and trade in world’s fastest growing economy.”