Background

Background

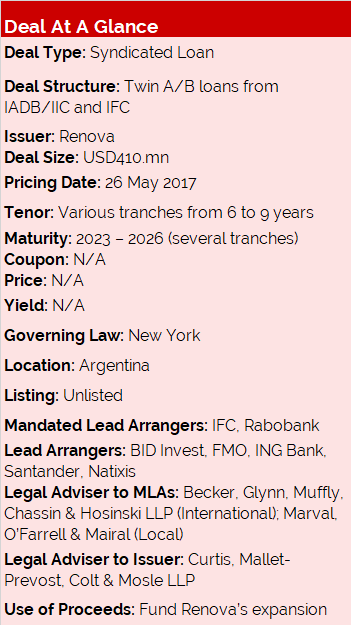

Renova is a joint venture between Argentina’s Vicentin and a Glencore AGri subsidiary Oleaginosa Moreno Hermanos; the company is engaged in soybean crushing, producing oil, meal, biodiesel, pure and refined glycerine.

In Spring 2017, Renova was looking to secure funding for its expansion plans, which included enhancing its port infrastructure in order to improve logistics and competitiveness in the oilseeds and grains supply chain in Argentina.

The borrower’s priority was to maximize tenors by way of securing funding that was commensurate with the long-term nature of underlying Capex.

On 26 May 2017 the company was able to close the largest agribusiness debt financing deal in Argentina, lead by IFC and Rabobank, which provided an A/B loan of USD75mn each, and the rest syndicated with a group of local and international lenders including ABN Amro, FMO, IADB/IIC, ICBC, ING Bank, Itau, Natixis, and Santander. The IFC and IADB/IIC acted as Lenders of Record under two twin A/B Loans of USD205mn.

The proceeds will go towards new capex that include a second grain port, a barges terminal, and a third crushing line that will increase crushing capacity from 20,000 ton/day to 30,000 ton/day.

Transaction Breakdown

During the initial market sounding among a broad universe of institutions from the MLAs and bookrunners’ partnership networks, the key concern factor for most prospective lenders was the long tenors – 6 years and upwards, which previously was beyond the scope of most Argentinian borrowers.

Beyond that, pricing appeared to be on the low end at the time, potentially limiting the volume of funding considered by some of the commercial banks. Strong established partnerships with those lenders and the clear and transparent allocation criteria that gave priority to those committing to longer tranches allowed the implementation of a two-step syndication process.

The first stage of the deal involved locating and preliminarily securing funding from DFIs and MDBs for the longest tranche, alongside funding from Rabobank and IFC; the second was to invite commercial banks that previously expressed interest during market sounding exercise.

Eventually, a multi-tranche structure with tenors ranging from 6 to 9 years was agreed, aimed at accommodating individual banks’ constraints. The complex mirror-loan structure allowed for the participation of three multilateral development banks – the IFC, the IIC as Lenders of Record, and FMO as Participant.

With over 90% of commitments at tenors of at least 7 years, competitive pricing relative to top Argentina credits, and an oversubscription rate of 60%, the Renova facility was a resounding success, representing the longest tenor for the borrower and among the longest tenors ever seen in Argentina’s agribusiness sector – and the country’s broader corporate universe.

It allowed the borrower to maximize tenors while securing funding for its expansion initiatives and signalled strong market appetite for structured transactions from Argentina’s top credits, while also helping to further develop the export-oriented agriculture and commodities sectors. It also demonstrates the scale of liquidity chasing a limited pipeline of financing opportunities and the attractive return rate on the back of improving macro conditions.