Egypt’s economy, barring some bumps along the way, has fared surprisingly well following the floatation of the pound last summer and the ensuing reforms, all of which contributed to the IMF’s decision to finally approve the third instalment of its USD12bn three-year loan in late December. After dropping the FX rate cap, the country made further progress on the reforms front, adopting a value-added tax, cutting energy subsidies, and removing crippling limits on FX transactions for importers of “non-essential” goods.

As a result, Egypt’s economy is expected to grow 4.2% in 2018, well above initial estimates, while the inflation rate, which was in excess of 33% in August, has since declined, and is expected to fall near the 13% mark by the end of 2018. The country’s FX reserves, which were at an all-time low in March 2013, have bounced to an all-time high of USD36.7bn in November 2017, while the Egyptian pound remained fairly stable, hovering near the 18 per USD mark since July.

“At the macrolevel, things look comparatively good in Egypt,” said Harry Boyd-Carpenter, Director, Head of Power and Energy Utilities at the European Bank for Reconstruction and Development (EBRD). “The IMF programme and the associated reforms, including the abandonment of the peg, was the single most important development in the last year.”

Still, there is a long way to go. The key question on the macro side now is whether the economy can generate enough jobs for the country’s young population, and whether economic growth will be sufficient to mitigate the effects of inflation, he explained.

Despite a significant increase in capital flows into the country, with the government targeting around USD10bn in FDI during fiscal year 2017/18, significant economic risks remain, mostly around uncertainty over the exchange rate and, therefore, the ability to achieve the government’s fiscal targets. These underlying threats are reflected in its B- rating; after the loss of its investment grade rating in 2002, attracting long-term capital into the country has been a struggle.

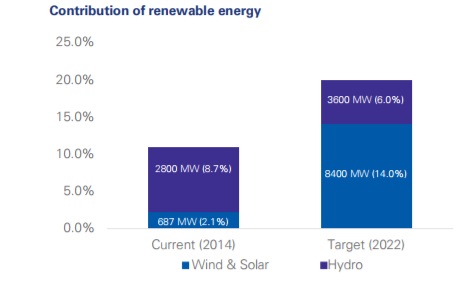

That has been true for one of the most ambitious ventures undertaken by the government: its drive towards energy diversification, announced in late 2014. The government revealed a large-scale programme to increase its share of renewables in the country’s power mix to 20% by 2022 and 37% by 2035 – up significantly from just 3% at the time. For a country where domestic gas production fed over 90% of installed capacity until facilities ground to a halt following the Arab spring, only to be followed by the collapse of oil and gas prices in 2014, this will be no small feat.

Crucially, the authorities were adamant that the private sector will eventually pick up a hefty chunk of the tab – private developers, investors and commercial banks are expected to lead as much as 60% of the projects, the government stated.

Crucially, the authorities were adamant that the private sector will eventually pick up a hefty chunk of the tab – private developers, investors and commercial banks are expected to lead as much as 60% of the projects, the government stated.

The programme consisted of several phases of development, with the first two involving a feed-in-tariff (FiT) scheme and two state entities, New and Renewable Energy Authority (NREA) and the Egyptian Electricity Transmission Company (EETC), offering tenders under a build-own-operate (BOO) contracts, and with the latter purchasing the energy produced under a 20-year PPA.

Yet, contextualized against the backdrop of the economic issues the country has faced over the past few years, and amidst global concerns over Central Banks’ unwinding in coming years, the programme has been an overwhelming success.

“They passed the feed-in tariff decree in October 2014, and three years on, they’ve reached financial close on more than a gigawatt of projects – that is an impressive result especially for the first of a kind programme in an emerging market” said Boyd-Carpenter. “The programme stimulated a lot of interest for close to 30 projects, with more than 10 top quality international and domestic sponsors committing serious capital to Egypt, and created a new investor base for the sector.”

Throwing a FiT

Still, despite the growing participation from international developers and financiers, the feed-in tariff programme had hit some snags, particularly at the early stages. The generous tariffs being offered for solar and wind projects reflect a number of serious risks that continue to be associated with the programme, where payments are made in Egyptian pounds, which threatens delays in converting to foreign currency and carries exchange rate risk.

As a result, and with additional complications arising from some regulatory changes, FiT Round 1 of the tenders nearly fell through after the government in the last moment removed the international arbitration clause from the contracts, which spooked a lot of potential sponsors and investors. Some industry observers, who preferred to speak off-record due to their ongoing work in the region, speculated that the clause was added deliberately as the government hiked the tariffs – after seeing similar projects at lower costs assigned in Jordan and the UAE at the time.

The authorities reacted quickly and implemented several measures to address investor concerns. Under pressure from DFIs, it brought back the international arbitration clause, and then nearly halved the tariffs to USD0.084 per kWh in the second round, from USD0.1434 cents per kWh in the first. It also offered a range of covers and guarantees.

“The initial issue was the tariff, coming to the market and retracting again, so that only the small-scale projects were picked up,” said Khaled Nabil Khorshid, Senior Vice President, Head of Syndications & Structured Finance at Union National Bank in the UAE. “The tariff has now been revised so things are heading in the right direction.”

However, the main concern for investors – the FX rate and hard currency liquidity – were still largely intact. According to Ahmed Alaa, Project Finance & Syndication Senior Officer, Debt Capital Markets at Commercial International Bank (CIB Egypt), the new schemes are structured in such way that FX risk is hedged or covered, with more of the proceeds offered in USD, making it more viable and attractive for investors. The government also passed legislation allowing for IFIs to support the capital base of local banks, which opened the door for development banks.

As a result, in October the European Bank for Reconstruction and Development (EBRD), the Green Climate Fund (GCF), the Islamic Development Bank (IDB), the Islamic Corporation for the Development of the Private Sector, and the Dutch development bank FMO came on board to provide USD335mn in funding to support Norway’s Scatec Solar in building six 50-MW plants in Benban, near Aswan,.

And in the following weeks, the EBRD became the single largest investor in the programme after agreed to further finance 16 solar plants, amounting to some 750MW, at the Benban complex under its USD500mn framework for renewable energy in Egypt.

The new batch of projects also drew in some big-name sponsors, including the French energy giant Engie, Saudi energy and water developer ACWA Power, Intesa’s ALEXBANK, Orascom, and a host of DFIs including the EIB, JBIC, AIIB, KFAED, and the Industrial and Commercial Bank of China.

Commenting to Bonds & Loans on Engie’s 20-year PPA with the EETC on the back of a competitive auction that saw one of the lowest onshore wind tariffs achieved yet, on the 250MW Ras Ghareb wind farm, Steven Fleurus, Engie’s Senior Financial Advisor on Acquisitions, Investments & Financial Advisory, said the company became an integral player in Egypt’s ongoing renewable energy transition.

“Egypt is a country which expects a strong power demand growth in the coming years to accompany its economic and social development. The Ras Ghareb wind project is definitely proof that good regulation can bring foreign investment at a competitive price to the benefit of African countries. For our Group it is an opportunity to scale up our presence in a strategic country with a long-term contracted asset guaranteed by the government,” Fleurus noted.

From DFIs to Commercial Banks

The arrival of development banks and other IFIs signalled a positive shift that could provide a range of benefits for projects. But going into Round 3, these DFIs will look to distribute the risks and financing obligations to local and commercial banks.

“The funding is mainly DFI debt so far, which is frustrating because we’d like to see more commercial banks come in. Right now, commercial banks have limited capital and appear to be wary of project finance,” admitted Boyd-Carpenter.

As most experts agreed, there are still a number of obstacles preventing an influx of capital from local and international banks. Long tenors represent a heightened risk for a lot of these projects, and with new bank capital regulations and scrutiny coming into force and costs of funding spiking sharply for tenors over 5 years, the risk premium becomes challenging to take on for most.

“We have seen borrowers more eager to obtain financing in foreign currency from ECAs and IFIs given local banks’ higher cost of funding and given local banks tenor constraints,” said Heba Abdel Latif, Head of Debt Capital Markets at CIBEG.

A further issue outlined by commercial bankers speaking to Bonds & Loans is on the regulatory side and concerns security perfection and mortgages; that is, how does one package a mortgage and enforce the underlying mortgage on what is at the end of the day a government entity?

Some of these concerns are addressed by the backing of multilaterals and DFIs. Zain Zaidi, Director of Loan Structuring & Syndication for Middle East at Citi bank, noted that the way lenders tend to look at the products offered by DFIs varies from bank to bank.

"IFC, IDB and others offer A/B loans, for example. If you are in a B-loan, you do not have any direct cover or protection from IFC or IDB; however, you benefit from the multilateral's status and negotiating power in case the deal runs into some difficulty or defaults, thus improving chances of recovery. They also offer products like political risk insurance, which can mitigate specific risks," he explained.

While those are more favourable conditions, they may not be enough to permit large banks to reassess their approach to the projects because there could be fundamental economic or other risks.

"The product that some DFIs offer which provides the greatest protection is the non-honouring of sovereign financial obligation coverage, which provides more comprehensive coverage to lenders against underlying defaults by the governments and government agencies," Zaidi explained. "That is the most powerful instrument which has the most appeal to commercial banks. However, they typically offer it in BB and higher rated countries."

Finding Solutions

While these challenges so far stood in the way of commercial lenders, there is a range of tools available to the government and the entities already on board with the projects to abate the risks. The key, most observers agree, is to develop more effective, flexible and sophisticated financing structures that either help to spread the risk, or shorten project tenors.

“An effective next step would be to encourage and develop subordinated debt or mezzanine finance schemes that would make them more appealing for investors,” commented Alaa. “Another solution is to start structuring deals in a way that enables local banks to finance longer tenors than what we have seen before.”

Coming up with complex financing solutions is not impossible in Egypt, as evident from the Egyptian Refining Company deal back in 2012. An impressive jumbo multi-ECA transaction, it involved a lender group comprising a mix of international banks, multilaterals, DFIs, regional banks and local banks – and a mezzanine loan from the AfDB to boot.

Financings for the coming projects could also involve structures such as soft or hard mini-perms, whereby following a project's completion pricing step-ups and cash-sweeps start kicking in to incentivize refinancing. A hard mini-perm will usually also have a legal maturity of no longer than 7 years.

"We spoke to a sponsor recently, who was finding broader appeal for a mini-perm structure because it works better with international banks capital models and risk appetite," Zaidi explained, but warned that this scheme puts higher risk on the sponsor, because if there is no market to refinance the deal, it could negatively impact their equity investment.

There are also debt instruments such as project bonds, used to great effect in other countries in the region like Bahrain and Oman; however, getting those off the ground is more challenging in a single B-rated economy.

As one industry observer explained, these instruments would fall into a sort of limbo where traditional projects finance investors would hold back due to the high risk on the asset, while EM buyers, which tend to focus on top corporates and government entities, would be reluctant to take on construction and other additional risks.

With the Egyptian capital markets still nascent, the big challenge is to develop the local banking sector and local-currency instruments that would eventually enable the creation of more effective hedging tools. One of the problems with issuing in local currency so far has been extortionate spreads: with the T-bills issued frequently and at very high yields, the prospective FI and private sector issuers have struggled to compete.

While it might be difficult to reduce the volume of the sovereign notes hitting the market, yields have to come down sooner rather than later, providing a path for local lenders.

“I would challenge the local banks to get more involved in these projects because so far they have held back,” Khorshid proposed. “They need to push local-currency tranches in the project financing, which has so far happened in just one or two cases. The main issue is not funding, but rather having the right currency; either borrowers or banks themselves have to include at least a 20-30% EGP component in these projects to make them appealing.”

According to Boyd-Carpenter, the projects in Round 3 will be outside the feed-in tariff, and will likely go down two routes: “More build-own-operate wind projects, larger scale than before, and, additionally, solar tenders – they recently launched a 600MW tender for a West Nile project, for example.”

A deadline of January 14, 2018, has been set for local and foreign companies to apply for prequalification, and contracts are expected to be awarded during the first quarter of 2018. NREA head Mohamed El-Khayat in recent interview Daily News Egypt hinted that more tenders were forthcoming, saying that the organisation would offer 400 MW of new wind and solar capacity in 2018.

There are also positive signals coming from the buy-side, with the likes of CIB and other commercial lenders seemingly ready to raise the stakes.

“CIB has played a prominent role in the FiT projects that were signed this year – it was onshore security agent and account bank for half the transactions; it is also providing a working capital facility and is onshore security agent and account bank for the Gulf of Suez project,” Abdel Latif stated.

China could offer a welcome solution to the problem of excessively long tenors – albeit, with certain conditions that could prove unpopular among the Egyptian public. They have different capital requirements and are less averse to longer tenors. However, they tend to only go for projects if there is a Chinese contractor or counterparty involved.

“If this Chinese nexus leads to entities like the China Development Bank coming in and providing support and guarantees, more investors would follow," Zaidi said.

With oil and gas prices edging up recently, it would be an easy out for Egypt to abandon the renewables push and revert back to the old ways. However, the success and appeal of the programme so far should incentivize the country to stick with the plan, and to encourage private and commercial banks to get their skin in the game and provide local-currency funding. After all, investment is all about quid pro quo.