Background

Background

In a bid to raise capital for new projects and refinance existing maturities, Grupo Rotoplas – a leader in Mexico’s water market – sought to launch its debut capital markets transaction.

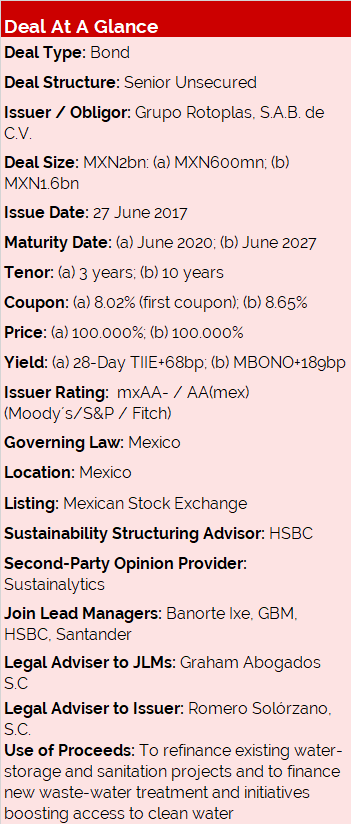

Off the back of strong support from the company’s joint lead managers, Grupo Rotoplas succeeded in a MXN2bn dual-tranche floating and fixed rate bond in the local markets.

Transaction Breakdown

Off the back of a local roadshow in Mexico, Grupo Rotoplas hit the market with a dual tranche MXN bond offering which included a shorter-dated floating rate tranche and a longer-dated fixed rate tranche.

The use of proceeds for the transaction included debt repayments for existing projects, but also covered about MXN550mn in funding for new drinking water solutions and wastewater treatment projects. Grupo Rotoplas successfully achieved a second-party opinion on the use of proceeds from Sustainalytics, allowing the instrument to officially qualify as a ‘Sustainability Bond’.

After assessing demand from investors, the bookrunners and Grupo Rotoplas opted to issue MXN600mn in 3-year notes and MXN1.4bn in 10-year notes, to help cater to investors with different risk profiles and to help smooth out the company’s existing maturity profile.

The transaction was launched on the morning of 27 June 2017, and off the back of strong demand – particularly from the country’s pension funds – the bookrunners were able to tighten pricing by 20bp across both tenors to achieve a final price of 28DTIIE+68bp on the 3-year tranche and MBONO+189bp on the 10-year tranche.

The final book was heavily dominated by pension funds (AFORES), particularly the longer-tenor tranche, a sign of growing appetite for sustainable investments among the country’s long-term institutional investors. Pension funds were allocated 68% of the book, with bank treasuries taking 18% and private banks 12%. Mutual funds were allocated 2%.

The notes were sold entirely to local investors during the primary sale, and they are listed on the Mexican Stock Exchange (Bolsa Mexicana de Valores).

The bond sale marks a trio of impressive firsts for the company and the wider sector. It was Grupo Rotoplas’ debut capital markets transaction, the first sustainability bond from a Latin American corporate, and Mexico’s first sustainability bond.