Qatar is facing the threat of international isolation after several neighbouring states cut ties with the country, accusing it of supporting extremism in the Gulf region.

The GCC group, led by Saudi Arabia and the United Arab Emirates (UAE), closed their land borders and the airspace around Qatar. Altogether, six countries – Bahrain, Saudi Arabia, the UAE, Yemen, Libya and the Maldives – cut diplomatic ties with Qatar last week, with Bahrain, Saudi Arabia and the UAE giving Qatari nationals two weeks to leave. They also banned their own citizens from travelling to Qatar.

The situation appears to have been ignited by a comment published on the state news agency (QNA) website, initially attributed to Qatar’s ruling Emir, stating that Iran should be considered a significant regional power. Soon afterwards, Qatar’s representatives denied the veracity of the comments, and claimed the website was hacked.

Middle East experts who spoke with Bonds & Loans say that while the situation escalated quite rapidly, it is not altogether surprising as it was borne out of tensions that simmered over many years.

Kuwait – one of the Gulf countries not involved in the dispute – has offered to mediate talks, and Qatar said it was receptive to dialogue. But while the stalemate continues, the risks – for Qatar and the region as a whole – multiply, ranging from geopolitical to economic and logistical.

Among the key concerns is the presence of a large US military base in Qatar. Continued pressure from its GCC partners could push Doha to strengthen ties with Iran, which would ramp up geopolitical tensions, with direct US interests under threat.

The dispute and the closing of airspaces could lead to travel chaos and blocked off trade routes, leaving Qatar completely cut off. This could also affect the delicate balance reached by GCC states over OPEC cuts – with potential ramifications on supplies and the price of oil.

According to Ian Black, Middle East expert at the London School of Economics and Political Science (LSE), these latest developments could lead to tectonic shifts in power dynamics within the region, and could see some of the players reassess their allegiances. That also includes the US, with the current administration’s somewhat fluid position on the crisis adding further uncertainty.

“All these sanctions are also coming to a head on the back of Donald Trump’s decision to reverse a lot of Obama’s developments, particularly the nuclear deal with Iran. Trump’s recent trip provided an opportunity for the Riyadh to make a move, however I don’t think that it was explicitly sanctioned by the State Department,” Black noted.

Kuwait and See

In the meantime, investors and banks working across the region are stuck in limbo, unable to predict which way the situation will swing.

Some remain more optimistic. Renaissance Capital economist Charles Robertson said that he is struggling to rouse much interest in this diplomatic row.

“Relations have been poor before – though not this poor, as I recall – during the Arab Spring. Some reports say this is related to Trump's recent visit and the fight against terrorism. Qatar was already downgraded at the end of May; its first ever downgrade since receiving its first rating in 1996. But at Aa3, financing should remain cheap and Qatar has plenty of resources to fund the World Cup.”

“Relations have been poor before – though not this poor, as I recall – during the Arab Spring. Some reports say this is related to Trump's recent visit and the fight against terrorism. Qatar was already downgraded at the end of May; its first ever downgrade since receiving its first rating in 1996. But at Aa3, financing should remain cheap and Qatar has plenty of resources to fund the World Cup.”

Others, however, are getting nervous – not least because the region’s Central Banks have not provided much if any guidance as of yet. Credit rating agency Moody's Investors Service released a statement saying it is concerned that the rift could have an impact on Qatar's credit outlook, if trade and capital flows are disrupted.

The average spread paid by Middle East sovereigns on the bond markets has risen 7bp since the row started, compared with a 3bp decline for emerging-market debt, according to Bloomberg. Yields on Qatar’s US$3.5bn in bonds due 2026 rose 3.5% last week, the highest since March.

The silver lining, according to a report by Emirates NBD, is that the impact is likely to remain contained given material regional holdings and possible demand from Qatari and Kuwaiti banks.

“The sell-off in Qatari bonds has made them more attractive relative to their ratings which could draw interest from yield chasing foreign investors,” claimed the report’s authors.

Still, it is too early to tell the extent to which the row will stretch into the future, said one investment manager in Dubai, who preferred to remain anonymous. “The Central bank has been asking for the exposures of all the banks to Qatari debt. No one in the finance world can really tell at this stage what will happen down the road.”

The investor noted that so far, he has not seen much of an impact on Qatari credit markets, but noted that “in the course of next few weeks I’m sure that ongoing deals with Qatari entities will be frozen.”

Another source told Bonds & Loans of at least one UAE bank had to pull a “fairly sizable” deal in Qatar because of the escalating tension.

The Emirates NBD report pointed out that Qatari banks have become increasingly reliant on external liquidity, with declines in deposits reaching -3.5% in 2016. Banking sector sanctions could take a toll on Qatari lenders.

“While there are no restrictions on financial flows yet, there is a risk that Saudi/ UAE banks refuse to roll over money market loans or reduce exposure to Qatari banks which could put some strain on the banking system. SAMA has already instructed Saudi banks not to buy Qatari Riyals. Qatar Central Bank data shows that the gross foreign liabilities of Qatari commercial banks stood at US$124.5bn at the end of April, and net foreign liabilities stood at USD 50bn.”

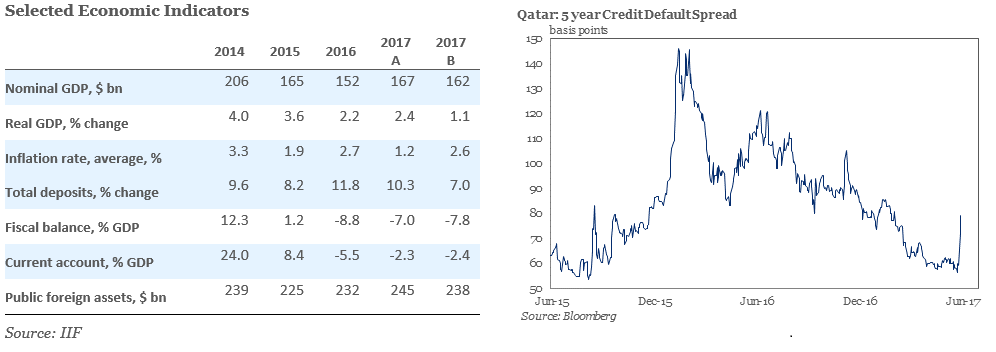

In a recent report the IIF proposed two possible scenarios for the ongoing spat, and possible impact on the region’s economies. While the first scenario implies a swift and effective resolution of the conflict, the second assess economic impact of a 6-month or longer stand-off.

According to the report, such a scenario could see alternative trade routes emerge, which would adversely impact exporters in the UAE and Saudi Arabia. Imports from the UAE, Saudi Arabia, Bahrain, Egypt, and Jordan accounted for about 16% of Qatar's total imports in 2016, or 3% of GDP.

“In the more pessimistic scenario… headline growth could decline to 1.2% in 2017 and 2.0% in 2018, principally due to lower non-hydrocarbon growth impacted by increased uncertainty weighing on investment and a tighter financial environment and perhaps deposit flight which could raise the cost of funds. Cuts in financial ties and increased counterparty concerns could hinder ease of doing business and trade finance.”

The report also states that while the currency peg is expected to remain in place in Qatar, the recent political turmoil has put pressure on the riyal.

“This is evident from the dollar-riyal 12-month forward points, which rose from 202 on June 2 to about 400 on June 7, 2017 and the CDS spread widened. This means that traders desiring to exchange Qatari riyal for dollars 12 month from now would have to pay QAR3.69 per dollar using outright forward contracts,” noted the IIF researchers.

Ultimately, it is in the interest of both Qatar and its GCC partners to find ways of resolving the situation quickly. The key to this, Black thinks, could be in third party hands. In particular, Kuwait and Oman, which were seemingly dragged in to the row without necessarily explicitly supporting these measures, and which have already attempted to mediate and diffuse the situation.

“In a region where we see a series of linked crises it is essential to have a degree of unity and solidarity to deal with ISIS and other extremist groups among other things. The hope is that the Gulf states will find a resolution to this and a way to move forward,” Black concluded.