Background

Background

ACWA Power sought fresh funding in a bid to diversify its sources of financing, raise longer maturity capital commensurate with the maturity profile of its asset base, repay certain existing facilities, and enhance its funding flexibility.

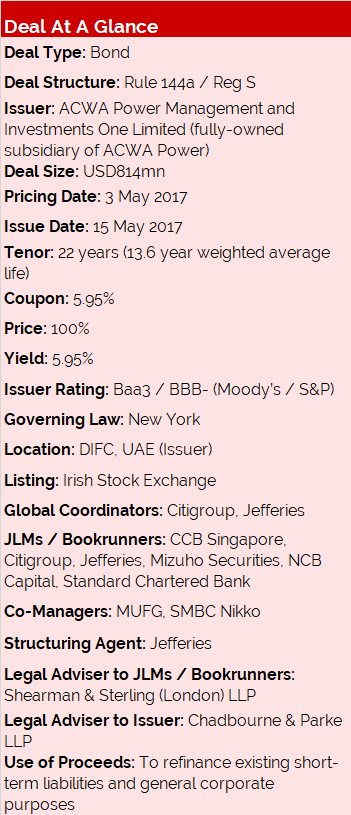

The effort culminated in the company’s debut international bond, a US$814mn bond due 2039 and secured by cash flows and other securities from 8 of ACWA Power’s power generation and water desalinisation projects in Saudi Arabia and the related operations and maintenance.

Credit Overview and Marketing Process

The bond is structured like a project bond in that the entire portfolio is ring fenced with irrevocable assignments of certain dividends and fees in favour of the bondholders, which also have pledges over the equity of certain companies and certain bank accounts – much like a project finance deal. The structure was designed to ensure project companies retain operational and financing flexibility, but that bondholders are protected from releveraging or asset sales through certain provisions designed to maintain the credit profile.

The bank group conducted an extensive premarketing campaign, meeting with over 50 of the most active market participants across the private debt, infrastructure and emerging markets globally, which became the anchor investors once the deal was announced.

In November 2016, the roadshow delegation led by ACWA Power senior management conducted a comprehensive marketing effort across the GCC, Asia, Europe and North America.

The project team educated investors on the Issuer’s credit story, the structure of the transaction as well as power developments in Saudi Arabia and maintained investor dialogue via the bank group through the new year once financials were updated.

While the underlying credit and cashflow profile – the individual power and water plants – was very strong, there was a significant amount of project finance debt outstanding on each asset, a concern for some investors; much of the roadshow focused on educating investors on the nature of the contracts these project companies have – which are essentially predicated on availability-based capacity payments, with a number of contractual protections built in.

There was an inherent risk with such project financing arrangements that dividends from some of these assets would breach restricted payments tests in the early years and stop distributing cash to the holding company. However, this risk was mitigated by the large and diversified asset pool, the solid operational track record of ACWA Power and this portfolio in particular, and the critical nature of further developing national utilities infrastructure.

As this was the first investment grade private sector offering from the Kingdom of Saudi Arabia, the marketing team also spent a great deal of energy educating investors about the sovereign’s credit story.

Transaction Overview

The transaction was announced on 24 April 2017. The issuer then conducted a series of 1-to-1 conference calls with investors during the week.

The issuer announced formal price guidance of 6.25% immediately after the bank holiday on Tuesday 2 May, with bookbuilding commencing when the London market opened. On Wednesday morning, the Issuer tightened its price guidance to 6.00-6.125%

A total of over 120 investors participated in the transaction with a final orderbook of US$1.8bn, allowing the leads to tighten pricing to 5.95%. The notes were oversubscribed by 2.5x, suggesting strong demand for the long-tenor offering, and allowed ACWA Power to upsize the transaction from its original target of USD600mn.

American investors dominated the book, with about 54% of the notes being placed with accounts in the US, 15% in MENA, 12% in Europe, 9% in the UK and 10% in Asia. By type, asset managers took 71% of the offering, while private banks took 11% and long-term institutional investors (insurers, pension funds) accounted for 18% of the placement.