The Bank of Russia’s decision to remove some of the key figures and statistics regarding the small and medium-tier banks from public domain led some to question whether the banking sector clean-up has exposed health issues more serious than previously thought. The CBR will no longer publish some of the specific details in banks’ balance sheets in its reports, meaning that it will become increasingly hard to tell resident and non-resident, financial and non-financial clients apart.

In a move that goes against its strong commitment to transparency, the CBR also retroactively removed the said data from its records going back all the way to October 2015.

While the decision does not impact foreign investors and holders of Russian debt directly, it adds to the worrying trend of increasingly clandestine behaviour by the financial authorities. Earlier this year the MinFin was accused by some observers of “cooking the books” after Russia’s growth estimates were given and unexpected (and, some argue, undeserved) boost by a sudden change in methodology.

In April Rosstat, the national statistics agency, surprised economists by recording a GDP contraction of just 0.2% for 2016, much shallower than expected, and by revising the previous year's contraction to just 2.8% from an initial 3.7%.

While Rosstat's head Alexander Surinov argued that the recent decision to place the agency under the Ministry of Economy’s wing gave it additional resources and clout to improve its data collection, some local economists have been more sceptical.

Alexey Krivoshapko, a Moscow-based fund manager at Prosperity Capital Management, told Business Insider that “Rosstat's data seemed to have become less reliable during the recession”.

Now, as more information is taken out of public domain, economists began asking questions about the signals that send to investors about the state of Russia’s banking sector.

“The Central Bank is trying to play down the problems in the banking sector, where capital outflows through mismanagement and corruption amount to billions of roubles,” Sergey Aleksashenko, chief economist at Moscow-based branch of Brookings Institute, wrote in his blog. “The small and medium tier lenders are being suffocated by the consolidation, and their clients are now losing access to data that would provide an indication of a bank’s condition, which creates additional risk.”

No Data – No Problem?

Experts that spoke to Bonds & Loans also admitted the move towards secrecy could make some investors uncomfortable, but downplayed its impact on the banking system.

“In my view, the development is neutral with slight negative bias,” said Sergey Dergachev, Senior Portfolio Manager and Lead Manager for Union Investment Privatfonds. “Transparency in the banking system, including access to public statistics of the health of the banking sector, are always an important ingredient of our sector analysis, and when some statistics are withdrawn, it is usually a bad signal.”

Still, the investment expert goes on to point out that in the case of Russia, from Eurobond investor´s point of view, what matters most for holders of Russian Eurobonds is the health of key players, like Sberbank, VTB, Alfa Bank, and of course VEB, but less so, what happens in mid- and bottom tier part of banking universe.

“It sounds cynical, but smaller banks are in majority of cases not a player in Eurobond markets anymore, it has been still relatively quiet since sanctions on large Russian banks were put in place, and medium size banks are not in a rush to issue. Secondly, the trend towards structural tightening within Russian banking sector is ongoing, we have seen more closures and bailouts. Thirdly, nowadays Russian banks’ Eurobonds are driven mostly by global factors like impact of US Treasury on bond returns, and country specific issues regarding Russia, i.e. oil price risk or political risk,” he explained, noting that even when Tatfondbank issues, spreads of other banks and Russian corporates have not been hit by that news.

A European banker based in a Moscow branch, speaking off-record, agreed that the impact of this move is unlikely to cause a stir in the investment community – as long as it is not used as cover for more systemic issues.

“It may cause some concern, but it is a fairly niche group of investors that go into that deep level of detail when assessing Russian banks, so the impact will be limited,” said the source. “Admittedly, I don’t find particularly convincing their reasoning that this information may expose confidential information about particular companies, although there may have been instances where some transactions involving some sensitive institutions, such as large Rosneft transactions, that could have been behind this decision, but that’s mostly speculation.”

“Personally, I think long-term it shows less transparency, but I wouldn’t exaggerate it. Given the recent trends towards transparency, particularly in the difficult period of consolidation, I’d give the CBR the benefit of the doubt here.”

Aleksashenko also raised some concerns about the missing data potentially being traded on the black market by banking sector insiders, but the banker seemed sceptical.

“There is some possibility of insider trading, but in any Central Bank there is by definition always some insider information, so I don’t really expect to see such situations to arise.”

CBR Doubling Down on Rate Cuts

In another unexpected move recently, the Bank of Russia went ahead of schedule with its monetary easing programme, cutting rates by 0.5pp – 0.25pp more than was forecast - from 9.75% to 9.25%. “Inflation is moving towards the target, inflation expectations are still declining and economic activity is recovering. Given the moderately tight monetary policy, the 4% inflation target will be achieved before the end of 2017 and will be maintained close to this level in 2018-2019,” the CBR explained in a statement.

Commenting on faster-than-expected pace of easing, the banking source explained that the core driving factor was that real rate has actually been quite tight, affecting the entire economy and movement of inflation has been faster than expected. He argued that it was simply a judgment call by the CBR prompted by lower than forecast inflation outlook.

“It’s not a drastic change of plan, I don’t think that it is very significant; they are just simply moving up the schedule a wee bit faster. But the high real rate makes it difficult for banks, for borrowers, so that also came into play,” the source added.

Some figures at least seem to support the CBR’s upbeat sentiment, with the Bank expecting structural liquidity surplus to stand between RUB0.5tn and RUB1tn end of this year. According to a report by Fitch, that figure stood at RUB630bn end of February and moderate profits for the sector of around RUB56bn in January.

“We believe some of this money temporarily parked in the CBR will be used by banks to buy government bonds, as the government plans to increase net borrowings to fund the budget deficit. However the liquidity surplus will not disappear as the MinFin places temporary free funds with the banks, while budgetary spending feeds into customer deposits,” the report noted.

“The banking system is relatively healthy and the 2017 figures will look a lot better than those of 2015 and first half of 2016,” commented Senior Emerging Markets Credit Analyst Richard Segal. “But we should bear in mind much of the difference in measured performance is because of changes in provisioning levels, and the underlying variation in performance is not that significant.”

Under the surface, things may not be as bright and shiny as the CBR wants to portray them. According to the Central Bank’s own figures, it made a RUB43.7bn profit last year, a quarter of the 2014 figure, while expenditures went up from RUB89bn in 2015 to RUB106bn last year.

An overperforming rouble last year was another problem for the lender. The MinFin, according to its former chief Alexei Kudrin, carried out RUB2.1tn worth of interventions in 2016, selling the hard currency to the CBR, which then went on to print the equivalent amount in roubles. In order to compensate for this excess liquidity in the banking sector, the CBR was forced to significantly trim its interbank lending, which went from RUB4tn start of 2016 to a mere RUB1tn end of the year.

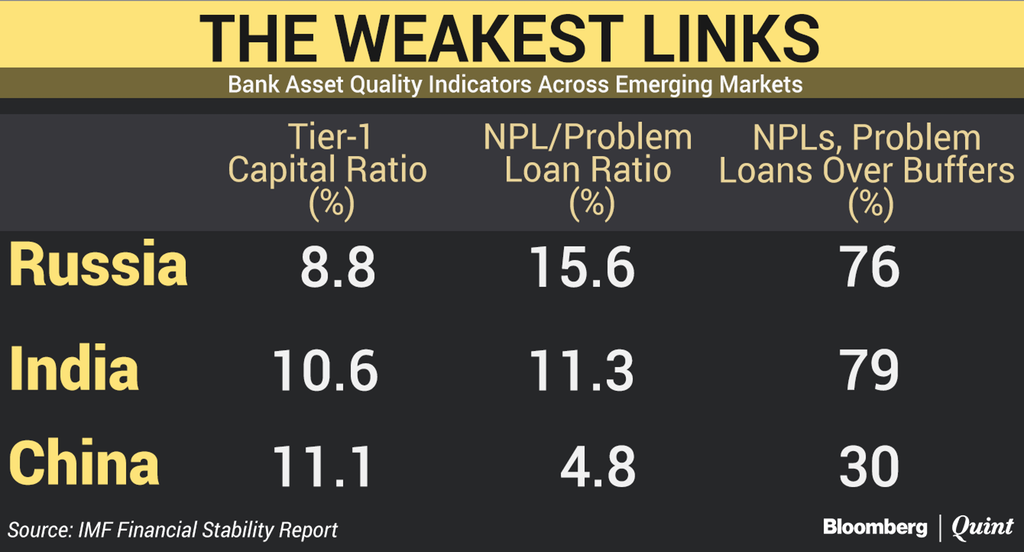

This materialized in a painful slowdown in sector activity, with the top-tier banks taking increasingly dominant roles. According to an IMF report, Russian lenders, on par with Indian counterparts, not only have the highest ratio of non-performing and problem loans (15.6%) but also the lowest Tier-1 capital ratios (8.8%).

And tellingly, of the RUB56bn in baking sector profits mentioned above, Sberbank’s share amounted to a hefty RUB47bn, or 84% of the whole sector. That reflects the highly-centralized structure of the sector, where state-owned commercial banks account for more than half of banks’ assets, with Sberbank and VTB group together accounting for 46,3% of total assets as of 2016.

“The system's assets are dominated by the top ten banks, which are either generally sound or will have taxpayer support, or have owners capable of supporting the bank through capital infusions if necessary,” Segal commented.

Church and State

The Peresvet bank has been a notable exception to this rule, as it has been propped up the CBR despite not being among the “strategically important” lenders (having barely made it into the Top-50 list last year before going into administration).

Having taken a no-nonsense approach with multiple lenders that have gone under in recent years as part of the CBR-driven consolidation, it has been uncharacteristically cautious with Peresvet – known as the Russian Orthodox Church bank, and reportedly a go-to lender for some prominent quasi-state corporates and government officials.

The negotiations are currently ongoing with Peresvet’s creditors and bond holders, many of which a Russian non-government pension funds, over its RUB100bn+ budget hole. The CBR already confirmed that it will allocate around RUB67bn towards the bank’s bail-out, with the rest of the burden expected to be distributed between its creditors.

“The intervention in Peresvet bank was surprising at the time, but necessary if the authorities would like their banking system to be fully up to international standards as quickly as possible,” Segal commented. “Once the Central Bank has been given the carte blanche to close or restructure non-viable banks, there is no reason why institutions perceived to be close to the church or other large banks should receive preferential treatment or advance notice - Otkritie was caught out by this decision, for example.”

A bank contact pointed out that, while not ideal, the solution picked by the CBR will at least provide some consolation to the debt holders.

“It is a special case, true, but we have also seen cases where the bonds were completely written off, so compared to that this is an improvement. They don’t have the legal tools to do it properly, so it is being done through a certain amount of carrot and stick, which are in this case pressure on the creditors and the CBR’s decision to provide some relief, if creditors accept the bail-in.”

The source reasoned that while it is net positive in the sense that it shows the CBR can work out a mechanism that leads to a successful resolution, but it depends on having the legal channels to do this.

“The bigger concern here is the question whether Peresvet can survive as a bank after effectively spending 6 months with no business going on. The idea is to keep living institutions, but does it make any sense to bring it back to life into some kind of zombie-like existence?”

This concern, among others, will be simmering in the back of investors and bankers’ minds as the clean-up of the sector progresses. The fact that much of the sector is cut off from international markets could actually aid this process, as underperforming banks are unable to overleverage themselves via the debt markets.

“Russia’s banking sector is currently in a world of its own, due to sanctions, which are unlikely to be lifted anytime soon, and key risks for bond holders is mostly external, mainly from adverse interest rate shocks and negative headlines about Russian political and country risk etc. But, fundamentally, since it is so insulated, debt is tightly held by mostly Russian investors and micro level events have limited impact on debt pricing,” Dergachev concluded.

This susceptibility to external and geopolitical shocks and, at the same time, a top-heavy structure that puts so much weight on the balances of the biggest banks, mean that current signs of stability and growth are encouraging, they are also fragile, and require careful management from the Central Bank and Russia’s policymakers.