Background

The Brazilian government followed up its successful return to the debt markets in March 2016 with a long-tenor bond that paved the way for other Brazil corporates looking to tap the markets.

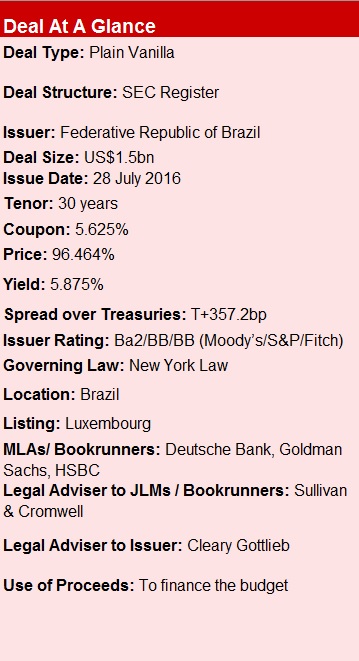

The transaction represented the first 30-year bond issued by the Republic since July 2014 and created an important reference in the longer tenor of the Brazilian sovereign curve.

Transaction Breakdown

On the back of encouraging economic data, including falling inflation and a rebound in industrial production and retail sales, Brazil in 2016 was beginning to project an image of a recovering economy.

Latin borrowers were also encouraged by the rally in US Treasuries that followed the Brexit vote, which triggered a corresponding rally in credit and helped flatten the curves of the region.

The strong market backdrop opened a window for Brazil to carry out an intraday execution for a new long 30-year USD benchmark on Thursday 21 July. The transaction was announced at 8:22AM EST as a new US dollar long 30-year benchmark SEC Global issue with an indicative price of “96bp area” and IPTs at “very low 6%s”.

Response to the transaction was extremely strong from the outset, with investor interest becoming immediately apparent as the orderbook was closed a mere 2 hours after announcement. Given the strong momentum with the orderbook, Brazil was able to take an aggressive pricing revision of 25bp from IPTs in order to test investor appetite at tighter levels. Official price guidance was released at 11:55am NYT, set at 5.9% area (+/-2.5bp.)

The final orderbook demonstrated high quality investor participation, allowing Brazil to launch the US$1.5bn transaction at 1:05pm NYT at 5.875%, with size and tenor in line with the Republic’s strategy of creating benchmarks in vertices of 10 and 30 years.

On this 30-year benchmark transaction, Brazil was able to achieve a yield 25bp tighter than where the Republic had priced its 10-year benchmark transaction in March, reaffirming the improved investor sentiment towards Brazil.

The yield outcome represents a single digit new issue concession when compared to the reference Brazil 5.00% of 2045s spotted immediately prior to announcement, underscoring the extremely aggressive pricing achieved in this historic transaction.

The books were heavily skewed towards the US, with 61% of the notes placed with US-based investors; another 18% was placed with investors in Europe, a further 11% in the UK, with the rest distributed between Latin American and Asian investors, 8% and 2% respectively.

In terms of type, 70% of the bonds was bought by fund managers, 15% by hedge funds, 8% by banks, and the rest distributed between retail (4%), insurance (2%) and pension funds (1%).

Overall, the transaction helped reaffirm foreign investor interest in Brazilian long credit, which translated into good demand and tight pricing terms.