Background

Background

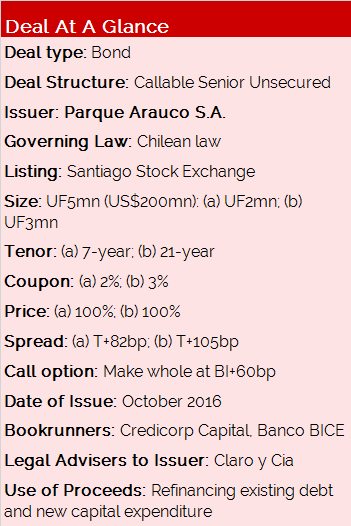

Parque Arauco issued a bond at the lowest yields in the history of corporate issuances in the Chilean capital markets, issuing at a time in the market when demand was high and rates were low, taking advantage of the company’s conservative long-term financing strategy.

The low bond yields were supported by impeccable timing due and high demand from investors, fuelled by the scarcity of bond issuance and Chilean Treasuries at their historical lows.

Transaction breakdown

The Company issued a 21-year bond with a 10-year grace period for UF2mn, at a 2.48% yield, with a 105bp spread over benchmark treasuries.

This is the lowest yield for a Chilean corporate bond issuance for notes with a duration greater than 10 years (excluding banks and state-owned companies). The company also issued a 7-year bond with a 3-year grace period, for UF3mn, carrying a 1.73% yield with an 82bp spread over benchmark treasuries.

This issuance also carried a historic low yield for Chilean corporate issuances (excluding banks and state-owned companies) with a duration greater than 4 years. Proceeds from the issuances were mainly used to refinance existing maturities.

In order to make the most of the favourable market conditions the company and its advisors executed the transaction very quickly. Advisors engaged with potential investors prior to the roadshow and after generating strong interest in the issuance they were able to tighten the spread over benchmark at which the bond could be called. This allowed the company to significantly compress the spread at which the bonds were issued.

This bond was part of Parque Arauco’s financing strategy to match the average duration of the contracts with its tenants by shifting its funding reliance from bank balance sheets to the capital markets. This long-term strategy was achieved by the company’s strong growth. Between December 2010 and June 2016 the company’s Gross Leasable Area (“GLA”) nearly doubled, reaching 873,000 m2. In the same period, the consolidated EBITDA grew 103%, reaching CLP$105.5bn in the last twelve months as of June 2016.

Secondly, favourable conditions were achieved thanks to the responsible financing policy of the company. Since December 2010, Parque Arauco has implemented three capital increases to finance growth, raising CLP256.3bn in the process. These capital increases, as well as the company’s retained earnings, has allowed the equity to increase 117% between December 2010 and June 2016, which amounts to CLP841.5bn as of June 2016.

Finally, attractive financial conditions were the result of the recent liability management exercise undertaken by the company. In the past three years, Parque Arauco has improved its credit rating classification two notches from A to AA-. In 2014, the company did a bond exchange to cancel the mortgages on its flagship property, Parque Arauco Kennedy, and improve the conditions for future issuances. In 2015, Parque Arauco issued a local bond that allowed the matching of the duration between assets and liabilities. More recently, the company refinanced and swapped its US dollar debt iinto local currency, and reduced its exposure to variable rate financial liabilities.