The Andean region has in recent years proven to be a beacon of stability and prosperity in Latin America, with Peru standing out as the star economy of 2016. In both Peru and Colombia, an inflation-driven monetary policy has been a key factor influencing their success. Peru’s Central Bank stuck to its tightening programme in 2015 to bring inflation back below 4%, dropping to 3.1% by the end of 2016. In Colombia, an economy more vulnerable to commodity price volatilities, inflation reached a 16-year high of 8.97% in July, but a timely rate hike programme helped trim that down to 5.75% end of year.

Recent predictions suggest that Colombia's economy will grow 2.4% this year, down from an estimate of 2.8% from last December. As the 3% inflation target also appears out of reach for now, there is some disagreement among the CB board members as to what course of action to take next.

“Now that inflation appears to be stabilising, the market expected the rates to come down in early February. As it happened, they didn’t go down on this occasion, but we expect [the Central Bank] to continue easing in the near future,” said Andres Marquez, Director of Financial Institutions for Fitch Ratings Colombia.

His sentiments are echoed by Finance Minister Mauricio Cardenas, who represents the government on the Bank’s board. Meanwhile, the Central Bank Governor Juan Jose Echavarria is more cautious about cutting rates further and suggested the Bank may slow down its easing policy.

“In the next few months, the Board will probably disagree as to the pace of the interest-rate reductions.”

In Peru, where the authorities have been able to maintain inflation within the 1-3% target range, rates are expected to remain steady for now.

Infrastructure Push

An annual forecast by Bloomberg analysts suggests that banks across Latin America will focus on reassessing loan criteria and corporate creditworthiness in the wake of a volatile foreign exchange market, inflationary pressures, and slow growth.

In the Andean states, commercial loans, fuelled by financing for multibillion dollar infrastructure programmes, are likely to be the key driver of lending growth throughout 2017 and 2018, though the shift to longer-term funding to better match these assets may pressure margins in the short-term.

Reliance on the banking sector, rather than the capital markets, for funding infrastructure development, combined with a fall in trade revenues and the resulting public spending cuts, have led to a minor liquidity crunch amid rising cost of funding, according to Marquez.

“In Peru, the problem is the FX rate impacting assets and liabilities. They are trying to address that issue now, but, unfortunately, people are still more inclined to save in dollars.”

While both countries suffer from currency volatility, Peru’s exposure to foreign liabilities is higher due to its dependence on trade.

“Looking at the balance sheet of Peru’s banking system, it has always had a significant amount of dollar exposure, partly due to its dependence on commodities,” commented Blackrock investor Jack Deino. “The flip side is that their debt to GDP is very low, they have a stellar sovereign balance sheet, so they have a significant cushion for volatility.”

According to Deino, following the Taper Tantrum of 2013, authorities realized the banking system in Peru was extremely vulnerable to bouts of extreme risk or exchange rate volatility. Since, there has been a concerted effort to de-dollarize banks’ balance sheets using a set of instruments that provide liquidity in domestic currencies and related hedging effects.

“If five or six years ago their dollar liabilities were around 55-56%, now that number is down to 30%, while the stock of dollar loans declined by 15% on average for the banking system,” the Blackrock portfolio manager noted.

Turning to Colombia, Marquez pointed out the principle difference with Peru: “Here, there is a drop in liquidity following the launch of a central account for public funds, which is being managed by the treasury, not the banks. Some of the additional funds are managed through this account, so it had an impact on liquidity.”

In July 2016 Fitch Ratings lowered its assessment of the Colombian banking system from stable to negative, calling on the country to further strengthen its banking sector. This was followed by a downgrade of a number of Colombian banks, including Corpbanca Colombia, Bancolombia, and Banco de Bogotá.

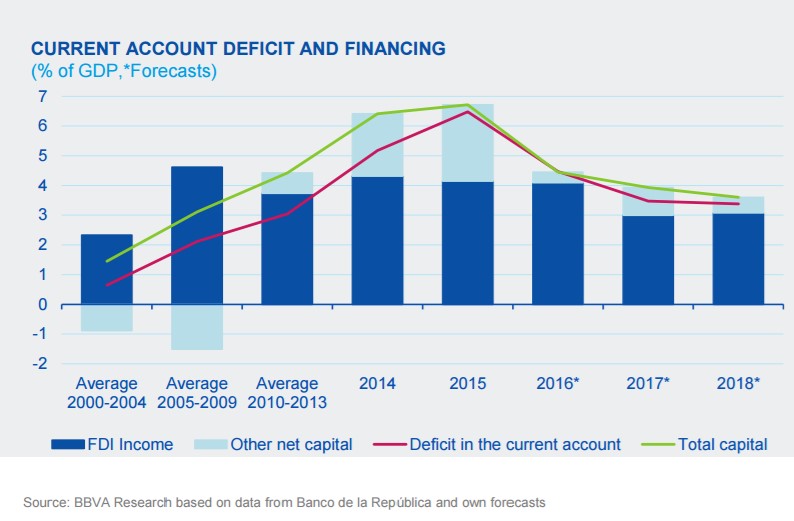

Fitch pointed to three major factors contributing to its bearish outlook: the rising current account deficit, which reached 6.4% of GDP in 2015; high external debt, at 37% of GDP; and a widening central government deficit —up to 3.9% of GDP in 2016, from 3.1% in 2015.

However, even by end of 2016 things were looking up, as the government managed to push the current account gap from over US$6bn to US$3.4bn by the third quarter of 2016, in line with expectations that it will level out at 5.3% through 2018.

Responding to the downgrades, the Colombian Financial Superintendency pointed out that banking sector solvency, at 15.46% in October 2016, well above the 9% regulatory minimum, was quite healthy.

The government agency also added that the risk rating does account for the state of financial regulation in the country, which the entity claims is among the strongest when compared to other countries in the region. Furthermore, the long-awaited tax reform legislation, approved by Congress in December 2016, is expected to bolster tax revenues via a new tax on dividends, an increase in the value-added tax, and a gradual reduction in income tax for businesses.

International think-tanks have echoed the sentiment, with the Washington-based Brookings Institution ranking Colombia second overall in its 2016 Financial and Digital Inclusion Project Report, giving it a perfect 100% score in terms of its commitment to financial inclusion, while its regulatory environment scored an impressive 89%.

Marquez also lauded Colombia’s efforts to improve and standardise the regulatory environment, but conceded that it is still early days.

“The Ministry of Finance has taken some steps towards adapt to Basel III more quickly. And while they are moving in the right direction, they still lack some of the best practices in the Andean region to fully comply with the Basel III requirements. They introduced Tier 1 and Tier 2 upgrades that have altered the concept of capital we were used to in the past. Now, for hybrids and additional Tier 2 instruments that will replace the former plain vanilla subordinated debt, the regulator has up to end of 2017 to implement this.”

But in many areas Colombia still lags behind. For example, only 39% of adults in Colombia currently have a formal bank account, and among women that figure is even lower – roughly 34%.

Deepening the financial and banking sector is a crucial next step for both countries if they want to continue financing wide-ranging infrastructure development. A key component of that is bringing millions of their citizens without bank accounts into the formal banking system.

The country’s capital markets remain very narrow, with corporates preferring to raise funds through banks, not via capital markets. Some steps have been taken by the government to further develop the secondary markets – for instance, secondary market issuances no longer require the issuer to have a rating. But, as Marquez emphasises, more work is needed on this front.

“For now, if you have an issuance below AA in Colombia or Peru, it is not appealing enough for institutional investors. The market needs to be educated to price a BB or B instruments, rather than AAA or AA+, and this is now happening.”

Clouds Ahead

Achieving these goals needs to be tackled in the context of growing economic and social risks, both local and international.

The Odebrecht scandal poses one of the biggest threats to the banking sector. In both countries, major projects were put on hold in order to assess the impact the corruption investigation might have on them.

In Peru, the scandal seems to have spread to the highest echelons of power, with an arrest warrant recently being issued for the exiled ex-president Alejandro Toledo. Meanwhile, the current president of Colombia, Juan Manuel Santos, has been under fire for allegedly accepting Odebrecht’s money to fund his re-election campaign.

“It is down to the government to calm the market by reassuring the banks that they will receive the money. Otherwise, this could lead to a chain reaction with other investors deciding to avoid the Andean financial sector out of precaution,” Marquez warned.

The ongoing negotiations with Colombia’s various rebel groups are yet another headache for Santos – having received the Nobel prize for securing the historic FARC peace deal, he is now under pressure to do the same with ELN, the last active guerrilla group.

Growing anti-globalist sentiments and risks surrounding US and EU trade policies could exert further pressure on Andean currencies.

Navigating these risks as budgets tighten, while also supporting the ongoing government initiatives, will be the major challenge for the Andean banking sector in 2017.