In 2012, Peña Nieto secured his presidential victory with a scant 38% of the vote. It is entirely possible that the next election could be won with an even smaller percentage. We are always concerned by the spending and policy ‘holidays’ that typically take place for about a year in front of the elections, and fear that with Mexico's political establishment still reeling from Trump’s election, the ‘holiday’ may be extended for the full 2 years beginning at the US election.

One of the major concerns for Mexico watchers is the continuation of the counterculture trend seen in recent elections (Brexit, US President), leaving the door wide open to a political unknown ascending to the Mexican presidency. While Andres Manuel Lopez Obrador (AMLO) is a known quantity, who we believe is far too much a part of the existing establishment to be a reaction to it, his populist rhetoric may fit well with anti-globalist trends. That said, we think the possibility of a new and unknown entrant, as outlined in Walter Molano's recent comment Mexico: The Invisible Man, is a real possibility and a key variable to watch.

Another possibility is that the rise of an unknown candidate could be facilitated by the single-round structure of Mexico’s electoral system. Given the rise of unaffiliated candidates and new parties in the last election, it is conceivable that a candidate could carry the day with as little as 20-something percent of the vote. While that outcome may not be consistent with the anti-establishment theme of recent elections around the world, it is certainly consistent with the pattern of unexpected outcomes.

Why do we care so much about Mexico? Because despite being overlooked in favour of trendy EM ideas like BRICs and frontier markets, Mexico is a leader among the developing world and is among the most attractive emerging economies given its strong reform program, favourable economic fundamentals, ties to a potentially faster growing US economy, the tailwind of a hydrocarbon reform that will attract billions in new investment in the coming decade, and a currency that is CHEAP, CHEAP, CHEAP!

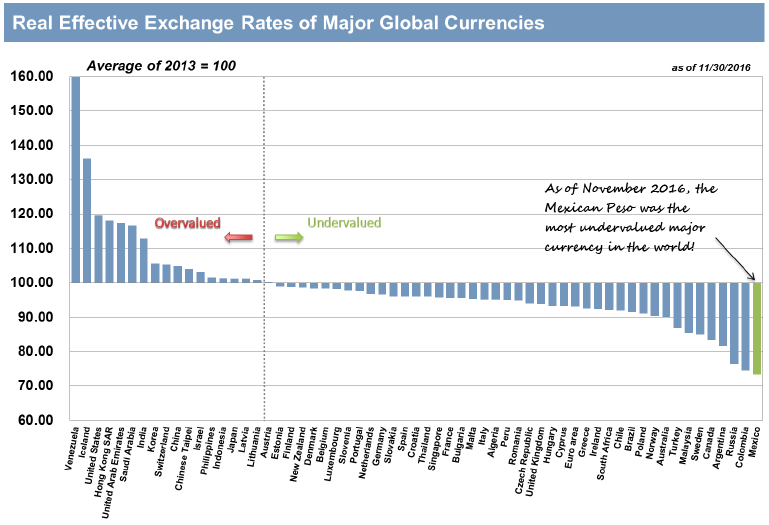

Even before the 2017 sell-off, the MXN was the most undervalued major currency in the world based on the Bank of International Settlements (BIS) Real Effective Exchange Rate (REER) index (which we have re-based to 2013). With the currency trading above 21.000 and seemingly reacting to each gust of Trump-related trade winds, the MXN is cheap by any fundamental measure and its current price discounts almost every conceivable event, save for the possible election of AMLO, a candidate who will likely foment a trade war instead of finding common ground with Mexico’s largest trade partner. Someday soon, the chickens will come home to roost, and the MXN will be proven to have been cheap. Unfortunately, it could be a full 18 months before we gain clarity on the next president and Mexico finds its feet.