Background

Background

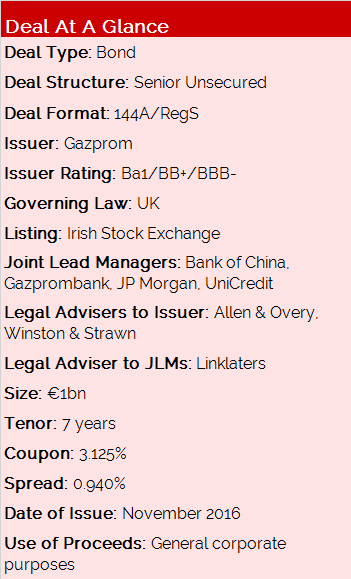

With Gazprom’s revenues largely denominated in euros and US dollars, the company sought to raise fresh euro-denominated capital for general corporate purposes and to refinance existing liabilities.

It successfully issued a €1bn 7-year Eurobond on 10 November.

Transaction Breakdown

After a roadshow held in Paris and London from 7 to 9 November 2016, Gazprom announced the opening of the book on November 10 with initial price guidance of “low 3%”. The deal finally priced at 3.1/8%.

During the roadshow, investors were particularly interested in the company’s geographical diversification into Asia, and whether it would then look to shift its debt strategy by issuing in Asian currencies alongside roubles.

The deal was notable given the investor distribution and the context in which it was executed.

This was the only deal of its size placed globally in euro markets within three days of Donald Trump securing a victory in the US Federal Elections, an outcome that ushered a brief period of relative uncertainty in global markets, and the euro market in particular. At the time, midswaps on French government paper were rising between 10bp and 20bp in intraday trading.

Given its strong fundamentals, an improvement in oil outlook, and the fact that it was the only corporate to issue benchmark-sized bonds in the euro market at the time, it was able to price with no new issue premium. Total demand for the bonds exceeded €1.35bn.

The placement was broadly diversified among international investors with a large number of bids coming from European accounts. The total number of investors in Gazprom’s Eurobond exceeded 130. It was also marked by active participation of Asian, as well as Russian investors, which was notable given the euro is not the home currency for neither Asian nor Russian investors.

In terms of geography, 22% of the notes were allocated to accounts based in Russia, 21% to the UK, 15% to Germany and Austria, 12% to Switzerland, 13% to Italy, other European countries 13%, and 5% to Asia.

By investor type, 53% of the notes were placed with banks, 32% with asset managers and funds, 8% with retail banks and 7% sovereign wealth funds and agencies.