Latin America

Bonds & Loans Latin America 2020 - Virtual Conference

LATIN AMERICA'S ONLY VIRTUAL CONFERENCE BRINGING TOGETHER BORROWERS, INVESTORS AND BANKERS

1 Dec 2020

Project Finance & Capital Markets Latin America 2020 Virtual

THE ONLY VIRTUAL EVENT BRINGING LATIN AMERICA'S PROJECT SPONSORS TOGETHER WITH BANKERS AND INVESTORS

19 Oct 2020

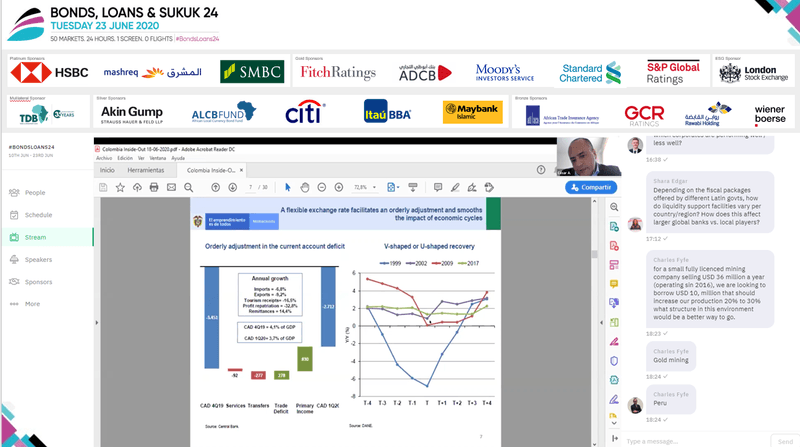

#BondsLoans24 - Colombia: Response to COVID-19, GDP growth and capital requirements

Cesar Arias, Colombia’s Director of Public Credit and National Treasury, discusses his country’s response to COVID-19, economic outlook for the country, and their recent experiences successfully raise capital on the international markets

16 Jul 2020

#BondsLoans24 - Evolution of structured debt (CRIs, CRAs, securitisation and illiquid strategies) in Brazil: Still a viable funding instrument following regulation updates and COVID?

Bruno Gomes (CVM), Guilherme Ferreira (Jive Investimentos), Lucas Drummond (Grupo Gaia), Leandro de Albuquerque (S&P Global Ratings) and Daniel Eskinazi (Soul Capital) discuss how Brazil’s structured debt market could provide a much needed alternative source of capital to corporates

16 Jul 2020

#BondsLoans24 - GDNs: Expanded Investor Access to Local Debt Securities

Justin Karol (Citi) explains how investors and issuers can utilise Global Depositary Notes (GDNs)2

16 Jul 2020

#BondsLoans24 - (in Spanish) Chile: Successfully issuing bonds to provide COVID-19 relief programmes

Patricio Sepulveda, Chile’s Head of Public Debt discusses his country’s response to the pandemic and their recent experiences successfully raise capital on the international markets

16 Jul 2020

#BondsLoans24 - (in Spanish) Paraguay: How COVID-19 will affect energy and infrastructure investment and policy for 2020/21?

Paraguay’s Minister of Finance, Benigno Lopez speaks to us about his country’s economic prospects, infrastructure developments, funding requirements and strategies to unlock investment

16 Jul 2020

#BondsLoans24 - Structured finance: Accessing capital where vanilla markets can’t provide it

Felipe Bomfim, Chief Financial Officer, Patria Infraestructura Carlos Linares, Chairman, COFIDE Juan Carlos Lorenzo, Head of Debt Capital Markets, Jefferies Moderated by: Kristie Pellecchia, Senior Advisor, Western Hemisphere, U.S. International Development Finance Corporation

16 Jul 2020

#BondsLoans24 - How is COVID-19 and the fall in oil prices impacting infrastructure deals in Latin America?

Jorge Camiña (Allianz Global Investors), Aurelio Bustilho de Oliveira (Enel), Eric Wittleder (Brookfield Asset Management), Leonardo Osorio (SMBC), and Adrian Garza (Moody’s Investor Service) discuss how infrastructure in Latin America will increasingly be financed by project finance loans and bonds

16 Jul 2020

#BondsLoans24 - What is the outlook for the privatisation programme, and investment in and out of Brazil in this new environment?

Rodrigo Tiraboschi (Privatisation Secretariat, Republic of Brazil) and Martha Seillier (Special Secretariat of the Investment Partnerships Program, Republic of Brazil) present plans for upcoming privatisations

16 Jul 2020

#BondsLoans24 - Brazil: How does the government plan to navigate its way back towards its economic vision

Luis Felipe Vital, Head of Public Debt at Brazil’s National Treasury speaks to Alexei Remizov (HSBC) about how his country is navigating its way back towards economic growth, and their recent experiences raising capital on international markets

16 Jul 2020

#BondsLoans24 - Size, price, tenor… but what are global banks’ criteria for lending to the region?

Benjamin Velazquez (ING), Jose Merigo (Societe Generale), Eduardo Zemborain (ICBC Argentina), Sara Pirzada (SMBC) outline their approaches, strategies and criteria lending into Latin America

13 Jul 2020

#BondsLoans24 - How to price deals in the current market where there are no reference points?

Alfredo Mordezki (Santander Asset Management), Jack Deino (BlackRock), José Martínez Sanguinetti (Rimac Seguros), Alessia Falsarone (Pinebridge Investments), and Juan Sebastián Restrepo (Skandia) debate how to price LatAm credit deals when there are no benchmarks.

13 Jul 2020

#BondsLoans24 - Bonds vs. loans, USD vs. local currency: How can borrowers access short, medium and long term capital?

Felipe Castilla (Grupo Energia Bogota), Leonor Salomon (Banco Santander Mexico), Raphael Dumas (SMBC) and Diego Vogelbaum (Itaú BBA) compare and contrast markets in search of the best solutions for borrowers in the current market environment.

8 Jul 2020