Islamic Finance

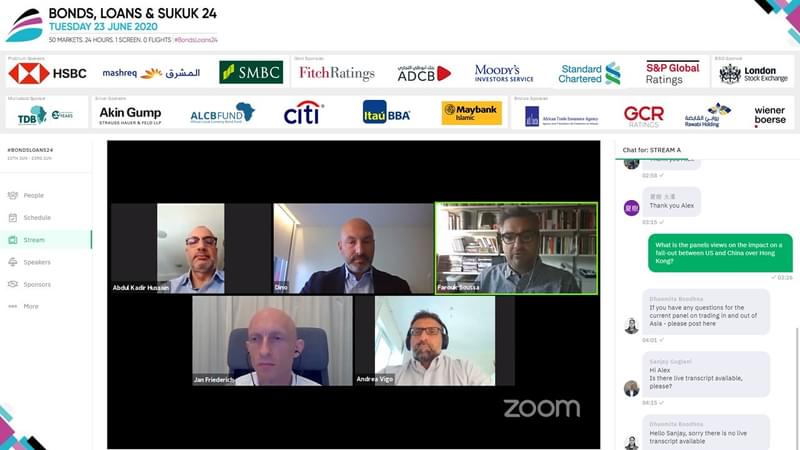

#BondsLoans24 - Market technicals vs. economic fundamentals: Are COVID-19 and oil price pressure properly reflected in GCC bond/sukuk spreads?

Mohieddine Kronfol (Franklin Templeton Investments), Abdul Kadir Hussain (Arqaam Capital), Andrea Vigo (EQUATE), Jan Friederich (Fitch Ratings), and Farouk Soussa (Goldman Sachs) debate whether GCC bonds and sukuk prices reflect underlying risk

8 Jul 2020

Sukuk Issuance to Plummet in 2020 – S&P

A toxic cocktail of low oil prices and widespread disruption caused by the COVID-19 pandemic looks set to severely inhibit sukuk issuance in 2020, according to a recent report from S&P.

15 Apr 2020

Ratings Agencies Expect Sukuk Issuance to Rise in 2020 Despite Global Slowdown

The asset class had a record-breaking year in 2019 and remains resilient as investors seek safer waters during a highly volatile period, experts at Moody’s and RAM ratings conclude.

2 Apr 2020

Saudi Banks’ Margins Squeezed by Fed Cut – Fitch

The US Fed’s recent decision to cut interest rates by a further 50bp is placing additional pressure on the margins of Saudi Arabia’s banks, according to a recent report from Fitch Ratings. Following the lead of the Fed, the Saudi Arabian Monetary Authority (SAMA) cut its repo rate on Monday by 50bp, bringing rates in the Kingdom to an all time low of 1%. But the Kingdom’s banks will feel the…

20 Mar 2020

Alhokair Group Inks Islamic Loan and Revolver with Local and Regional Lenders

Alhokair Group secured a USD800mn funding package this week from a handful of domestic and regional lenders in a bid to consolidate its debt, the company said.

5 Mar 2020

SWOT: KSA Dominates GCC Infrastructure Pipeline Despite Lack of Mega-Project Expertise among Local Developers

Bonds & Loans examines the strengths, weaknesses, opportunities and threats across the GCC projects and infrastructure space on the back of the latest Project, ECA & Structured Finance Saudi Arabia conference.

3 Mar 2020

MENA Borrowers Weigh Costs and Benefits of Debut DCM Deals as Appetite for Funding Diversification Grows

CFOs and Treasurers from across the region are looking at ways to diversify their funding base and reduce their dependence on the region’s deep-pocketed lenders, with the debt capital markets – which has grown leaps and bounds over the past decade – looking increasingly likely to be the dominant means of doing so. But how to shift internal cultures around disclosure, engage new investors, and…

20 Feb 2020

Regulatory Shifts May Help Boost Islamic Banking in the Philippines

New guidelines released by The Bangko Sentral ng Pilipinas (BSP) could pave the way for new sukuk issuance in one of ASEAN’s fastest growing economies.

22 Jan 2020

Issuers Shrug Off Geopolitical Risk as Investors Pile into GCC Bonds, Sukuk

A slew of GCC borrowers have moved to sell bonds and sukuk to global investors a further sign that regional borrowers and capital holders remain unperturbed by any perceived escalation in geopolitical risk.

17 Jan 2020

Islamic Finance to Grow at Slow Rate in 2020 – S&P Global

The Islamic finance industry is set to grow at a rate of around 5% in 2020, due to weak conditions in economic conditions in the industry’s core markets, according to S&P Global’s ‘Islamic Finance Outlook 2020’. The report also notes three drivers - the rise of FinTech, ESG sukuk, and standardisation - could fuel the industry.

15 Jan 2020

Sharia-Compliant Real Estate Lender Amlak Within Touching Distance of Debt Restructuring

Specialized Islamic real estate financier Amlak Finance PJSC has said it managed to agree credit restructuring terms with about 95% of its existing creditors, putting it within touching distance of finalising its second restructuring in five years.

9 Jan 2020

Brown Brothers Harriman: Emerging Markets Preview for the Week Ahead

EM benefited greatly from the improvement in US-China trade relations and quite possibly Brexit. The dollar is likely to remain under some pressure near-term as a result. Yet we must caution investors against getting too optimistic. The details of the partial trade deal still need to be worked out, while existing tariffs will still remain in place if the deal is signed next month as most expect.…

14 Oct 2019

SWOT Analysis: African Credit Markets in 60 Seconds

Bonds & Loans examines the strengths, weaknesses, opportunities and threats across Africa following a research trip to the region.

10 Oct 2019

SWOT Analysis: GCC Credit Markets in 60 Seconds

Bonds & Loans examines the strengths, weaknesses, opportunities and threats across the GCC following a research trip to the region.

3 Oct 2019