Ratings

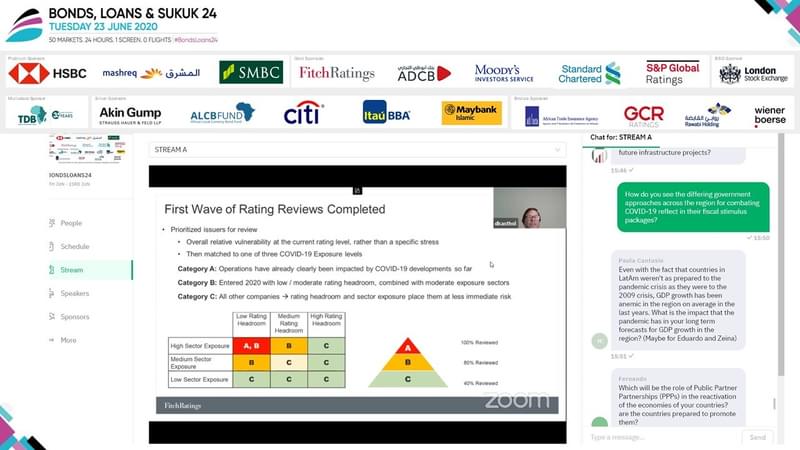

#BondsLoans24 - Latin America Corporates: The Path Forward

Daniel Kastholm, Managing Director, Regional Group Head, Latin America Corporates, Fitch Ratings

8 Jul 2020

#BondsLoans24 - Market technicals vs. economic fundamentals: Are COVID-19 and oil price pressure properly reflected in GCC bond/sukuk spreads?

Mohieddine Kronfol (Franklin Templeton Investments), Abdul Kadir Hussain (Arqaam Capital), Andrea Vigo (EQUATE), Jan Friederich (Fitch Ratings), and Farouk Soussa (Goldman Sachs) debate whether GCC bonds and sukuk prices reflect underlying risk

8 Jul 2020

Moody’s: Coronavirus to Sharpen Focus on Credit-Relevant ESG Factors

The coronavirus pandemic is likely only to intensify focus on environmental, social, and governance (ESG) factors as investors scrutinise governments’ and companies’ preparedness for global risks including and beyond public health emergencies, Moody’s analysts say.

24 Jun 2020

The 'Battle' For South Africa

The looming contest over South Africa’s political direction will kick off with a dispute over IMF financial support to plug a massive gap in government revenues. Opponents of IMF conditionalities favour tapping into state pension funds or stepping up central bank bond buying to make up the shortfall. With ‘battle’ lines drawn across the ruling alliance’s ideological divisions, the outcome of the…

17 Jun 2020

Slew of Downgrades in India May Clash with Efforts to Attract International Bond Investors

India entered the COVID-19 crisis with a slew of pre-existing vulnerabilities. Now, with the country wracked by the impact of the virus, Moody’s has downgraded a number of notable Indian institutions, joining other rating agencies in placing the sovereign within touching distance junk status.

3 Jun 2020

GCC Debt Sees Strong Demand in Q2 But Worsening Outlook Raises Alarms

GCC sovereign bond issuance surged to USD26bn and attracted more than USD140bn in demand through the second quarter of this year as the region’s governments flocked to international markets to cover deficits sent wider by lower oil prices and depressed economic activity. Some analysts say investors should not be so quick to shrug off some of the macroeconomic pressures weighing on the region.

29 May 2020

OPEC+ Production Cuts Will Place Additional Strain on Nigeria’s Economy

Adhering to the recently agreed OPEC+ oil production cuts will only deepen Nigeria’s economic problems and exacerbate its difficulties with external finances, according to a recent report by Fitch Ratings. Whilst liquidity provided by multilaterals will help ease some pressures in the short-term, macroeconomic strains will continue.

20 May 2020

With Fiscal Gaps Widening, Analysts See Romania Risking its Coveted Investment-Grade Status

As budget gaps widen to historical highs, Romania, one of Eastern Europe’s most frequent bond issuers, is at risk of losing its coveted investment-grade status, potentially hampering the country’s ability to satiate its growing need for funding.

1 May 2020

IMF Debt Relief Programmes May Lead to More Defaults in Private Sector – Moody’s

This week the IMF announced plans to provide USD500mn in debt relief to some of the world’s poorest countries under its Catastrophe Containment and Relief Trust. All countries eligible for concessional financing from the World Bank are targeted by the G7’s debt service payments.

20 Apr 2020

EM Bond Covenants Strengthen Slightly – Moody’s

Emerging market covenant scores have improved slightly in the six months prior to 31 March, according to a recent report from Moody’s. The period saw covenant quality scores strengthen to 3.25 from 3.35 over the same period a year prior – far stronger than those seen on bonds issued in EMEA and North America, exceeding them in all categories except one.

20 Apr 2020

Sukuk Issuance to Plummet in 2020 – S&P

A toxic cocktail of low oil prices and widespread disruption caused by the COVID-19 pandemic looks set to severely inhibit sukuk issuance in 2020, according to a recent report from S&P.

15 Apr 2020

COVID-19, Rating Downgrade Push South Africa’s Economy Off the Edge

South Africa’s ailing economy has long teetered on the edge of a recession, with only a light breeze needed to send it off the cliff. Is the coronavirus pandemic, which has intersected with the Moody’s downgrade of the sovereign to junk, a death knell for the continent’s second largest economy?

15 Apr 2020

Pandemic to Squeeze Margins at GCC Banks – S&P

The COVID-19 pandemic combined with the subsequent slump in oil prices is a particularly dangerous combination for GCC economies given the region’s exposure to commodity prices. According to a report from S&P, the region’s banks face an earnings shock, with a notable slowdown in credit growth and higher risk premiums – although other key metrics remain strong.

14 Apr 2020

Russian Regions Squeezed by Rising Borrowing Needs, Soaring Debt Costs

Over the past two years the sub-sovereign bond market has been largely stagnant, but as budgetary constraints force regional issuers to tap the bond markets, rising costs of debt will act as an impediment.

8 Apr 2020