Energy

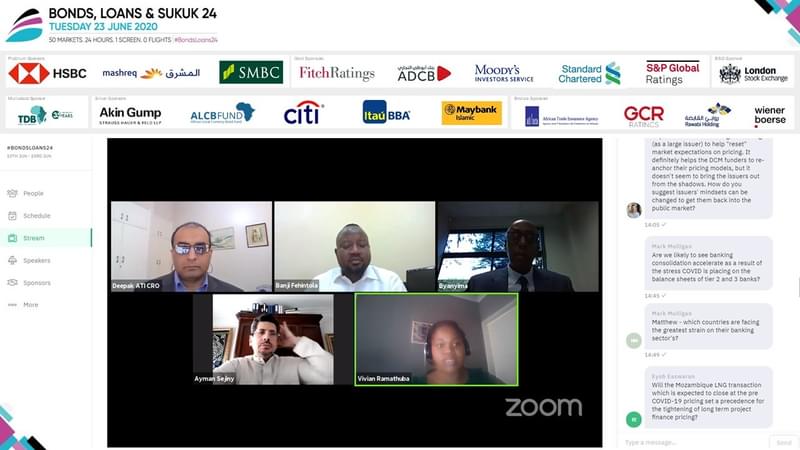

#BondsLoans24 - DFIs, IFIS and ECAs in Africa: A change of strategy or business as usual?

Deepak Dave (African Trade Insurance Agency), Banji Fehintola (Africa Finance Corporation), Vivian Ramathuba (New Development Bank), Ayman Sejiny (ICD) and Abraham Byanyima (Trade & Development Bank) discuss debt relief, social bonds, and the role of DFIs, IFIs and ECAs post-pandemic

17 Jul 2020

#BondsLoans24 - How to build back better: Incorporating strong ESG credentials while making tough cost and investment decisions post COVID-19

Esther An (City Developments Limited), Virginie Maisonneuve (MGA Consulting), Hardik Shah (GMO), Leong See Meng (Cagamas) and Sadiq Currimbhoy (Maybank Kim Eng) discuss the pros and cons of dedicating resources to ESG credentials when rebuilding post-COVID-19

13 Jul 2020

#BondsLoans24 - Managing oil and gas in an age of uncertainty

Mark Cutis (ADNOC), Renè Javier Aninao (CORBŪ LLC), and Alex Johnson (GFC Media Group) discuss how the oil and gas industry is impacted by brewing geopolitical tensions, re-regionalisation of global supply chain, and the upcoming US elections

8 Jul 2020

Financing During the Coronavirus Crisis: Lessons from an Investment-Grade Emerging Market Issuer

Coronavirus presented global businesses with several challenges – from enhanced safety protocols to supply chain disruptions and everything in between. However, while many market stakeholders predicted issues with attracting new funding, investment-grade companies have managed to largely overcome them.

30 Jun 2020

GEB CFO Felipe Castilla on Prudent Financial Management and Pricing Deals Through the Covid Volatility

CFOs and treasurers globally have spent the better part of the past three months adjusting to the severe economic disruption caused by the coronavirus pandemic, not the least of whom those looking to raise funding. We sat down with Felipe Castilla, CFO of Grupo Energía Bogotá, a state-owned energy conglomerate based in Bogotá and operating in select markets across the Americas, to talk about…

23 Jun 2020

Enel Americas CFO: ‘These are Challenging Times, but a Unique Learning Opportunity Too’

In an exclusive interview Bonds & Loans spoke to Aurélio Bustilho de Oliveira, CFO Enel Américas, about ESG, deleveraging and coping with the impact of the pandemic while also supporting the supply and value chains.

21 May 2020

OPEC+ Production Cuts Will Place Additional Strain on Nigeria’s Economy

Adhering to the recently agreed OPEC+ oil production cuts will only deepen Nigeria’s economic problems and exacerbate its difficulties with external finances, according to a recent report by Fitch Ratings. Whilst liquidity provided by multilaterals will help ease some pressures in the short-term, macroeconomic strains will continue.

20 May 2020

Oil Market is Rallying ‘Much Too Soon’ – ING

Oil markets continued to make a modest recovery this week amidst moves to ease lockdown restrictions in a number of countries worldwide. But a sustained recovery could be some way off, according to Warren Patterson and Wenyu Yao, commodities economists at ING.

19 May 2020

Emerging Market Oil & Gas Operators Could Benefit from Quasi-Sovereign Status

With oil having recently dipped into negative territory and investors turning bearish on emerging markets and other risk assets, you would think the prospects for emerging market oil & gas companies in international capital markets would be slim to nil. But you may be wrong.

6 May 2020

Celsia Taps Local Markets with a COP200bn Dual-Tranche Bond

The company – one of the most prolific and well-recognised issuers in the energy sector – came to market at a difficult time, but successfully secured 3.6x oversubscription on the new notes, with proceeds going to a bond buyback.

22 Apr 2020

Technical Factors See Oil Prices Diverge, Slip Into Negative Territory as Producers Approach Capacity Limits

Oil futures dropped sharply through Monday afternoon, with WTI leading the decline to close at negative USD37.60, the first time oil futures settled in negative territory.

21 Apr 2020

World Bank Approves USD500mn Loan to Ethiopia

The World Bank has approved a USD500mn loan to Ethiopia, in order to support the government’s ‘Homegrown Reform Agenda’, underpinned by the Second Ethiopia Growth and Competitiveness Development Policy Operation (DPO).

26 Mar 2020

Looking Past the Pandemic: Where Will the Opportunities Lie?

The advent of the COVID-19 pandemic has derailed the outlook of investors worldwide as growth and trade grind to a halt. With no clear end to the crisis in sight, many are increasingly bearish. But according to Hani Redha, Multi Asset Portfolio Manager at Pinebridge Investments, if investors look past what is likely a temporary downturn, then there are opportunities in the distance.

24 Mar 2020

Emerging Economies to see Boom in Off-Grid Renewables – Wood Mackenzie

Enormous strides have been made towards developing effective and affordable ways of generating power over the past decade, with technological innovation enhancing the viability of off-grid solutions. For emerging economies, a boom in off-grid energy will likely enhance access to swathes of the population, argues Wood Mackenzie. For state utilities, however, off-grid solutions could be…

18 Mar 2020