CFO Insights

#BondsLoans24 - Approaching the market: How are corporates managing their short, medium, and long-term funding?

Alwaled Al-Moaither (SABIC), Rajit Nanda (ACWA Power), Ahmad Alshubbar (Rawabi Holding Company), Manish Manchandya (Saudi Electricity Company), and Sabrina Al Bakri (OQ) discuss with Jean-Marc Mercier (HSBC) about their approach to fund raising post-COVI19

17 Jul 2020

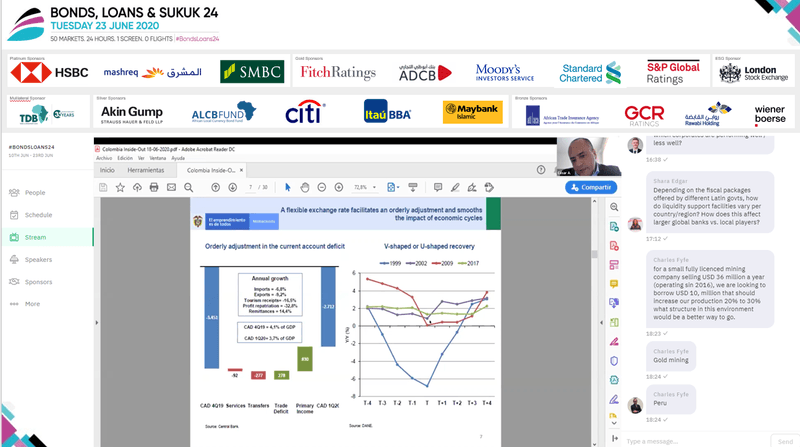

#BondsLoans24 - Colombia: Response to COVID-19, GDP growth and capital requirements

Cesar Arias, Colombia’s Director of Public Credit and National Treasury, discusses his country’s response to COVID-19, economic outlook for the country, and their recent experiences successfully raise capital on the international markets

16 Jul 2020

#BondsLoans24 - (in Spanish) Chile: Successfully issuing bonds to provide COVID-19 relief programmes

Patricio Sepulveda, Chile’s Head of Public Debt discusses his country’s response to the pandemic and their recent experiences successfully raise capital on the international markets

16 Jul 2020

#BondsLoans24 - (in Spanish) Paraguay: How COVID-19 will affect energy and infrastructure investment and policy for 2020/21?

Paraguay’s Minister of Finance, Benigno Lopez speaks to us about his country’s economic prospects, infrastructure developments, funding requirements and strategies to unlock investment

16 Jul 2020

#BondsLoans24 - How is COVID-19 and the fall in oil prices impacting infrastructure deals in Latin America?

Jorge Camiña (Allianz Global Investors), Aurelio Bustilho de Oliveira (Enel), Eric Wittleder (Brookfield Asset Management), Leonardo Osorio (SMBC), and Adrian Garza (Moody’s Investor Service) discuss how infrastructure in Latin America will increasingly be financed by project finance loans and bonds

16 Jul 2020

#BondsLoans24 - What is the outlook for the privatisation programme, and investment in and out of Brazil in this new environment?

Rodrigo Tiraboschi (Privatisation Secretariat, Republic of Brazil) and Martha Seillier (Special Secretariat of the Investment Partnerships Program, Republic of Brazil) present plans for upcoming privatisations

16 Jul 2020

#BondsLoans24 - Brazil: How does the government plan to navigate its way back towards its economic vision

Luis Felipe Vital, Head of Public Debt at Brazil’s National Treasury speaks to Alexei Remizov (HSBC) about how his country is navigating its way back towards economic growth, and their recent experiences raising capital on international markets

16 Jul 2020

#BondsLoans24 - How are Turkish companies managing finances and balance sheets in preparation for a change in the new world order?

Gorkem Elverici (SISECAM), Osman Yilmaz (Turkcell), Orhun Kostem (Anadolu Efes) and Teymur Abasguliyev (Socar Turkey Enerji) speak to Yigit Arslancik (HSBC Turkey) about their approach to financing post COVI-19

13 Jul 2020

#BondsLoans24 - Slovenia: Response to COVID-19, GDP growth and capital requirements

Marjan Divjak, Director General, Treasury Directorate, Ministry of Finance, Republic of Slovenia presents his country’s economic and financial response to COVID-19

13 Jul 2020

#BondsLoans24 - Belarus: How does the government plan to navigate its way back towards its economic vision

Belarus’ Deputy Minister of Finance, Andrei Belkovets, speaks about his country’s economy, investment plans and approach to financing

13 Jul 2020

#BondsLoans24 - Responding to COVID-19: How are Russian companies adapting to the new reality?

Mikhail Sychev (Gazprom Neft), Rostislav Rozbitskiy (EVRAZ), Ruslan Karmanny (Eurochem) speak to Alex Griffiths (Fitch Ratings) about their approach to fund raising post-COVID-19

13 Jul 2020

#BondsLoans24 - Estonia: Response to COVID-19, GDP growth and capital requirements

Marten Ross, Deputy Secretary-General for Financial Policy and External Relations, Ministry of Finance, Republic of Estonia presents his country’s economic and financial response to COVID-19.

8 Jul 2020

#BondsLoans24 - Corona social bonds: How does the pandemic make a stronger business case for pursuing strategic ESG integration into funding strategies?

Rahul Sheth (Standard Chartered), Elena Chimonides (London Stock Exchange Group), Axel Bendiek (Ministry of Finance of the State of North Rhine-Westphalia), Farnam Bidgoli (HSBC), Giulia Pellegrini (Allianz Global Investors) discuss the long term prospects of Corona social bonds and pursuing ESG integration into funding

8 Jul 2020

#BondsLoans24 - Bonds vs. loans, USD vs. local currency: How can borrowers access short, medium and long term capital?

Felipe Castilla (Grupo Energia Bogota), Leonor Salomon (Banco Santander Mexico), Raphael Dumas (SMBC) and Diego Vogelbaum (Itaú BBA) compare and contrast markets in search of the best solutions for borrowers in the current market environment.

8 Jul 2020