Projects & Infrastructure

#BondsLoans24 - DFIs, IFIS and ECAs in Africa: A change of strategy or business as usual?

Deepak Dave (African Trade Insurance Agency), Banji Fehintola (Africa Finance Corporation), Vivian Ramathuba (New Development Bank), Ayman Sejiny (ICD) and Abraham Byanyima (Trade & Development Bank) discuss debt relief, social bonds, and the role of DFIs, IFIs and ECAs post-pandemic

17 Jul 2020

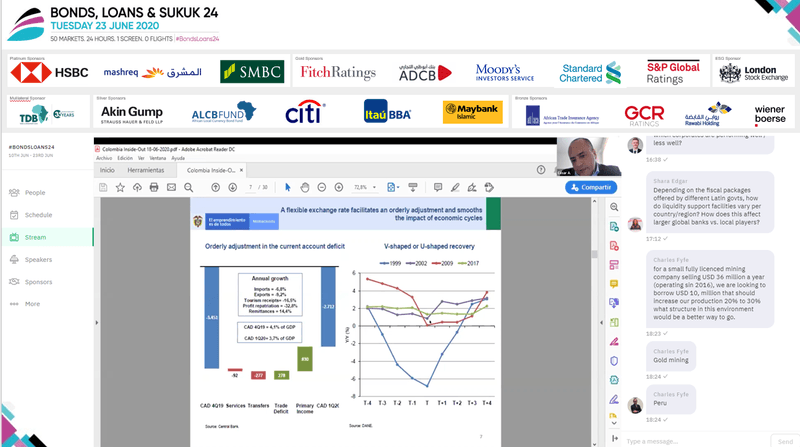

#BondsLoans24 - Colombia: Response to COVID-19, GDP growth and capital requirements

Cesar Arias, Colombia’s Director of Public Credit and National Treasury, discusses his country’s response to COVID-19, economic outlook for the country, and their recent experiences successfully raise capital on the international markets

16 Jul 2020

#BondsLoans24 - Evolution of structured debt (CRIs, CRAs, securitisation and illiquid strategies) in Brazil: Still a viable funding instrument following regulation updates and COVID?

Bruno Gomes (CVM), Guilherme Ferreira (Jive Investimentos), Lucas Drummond (Grupo Gaia), Leandro de Albuquerque (S&P Global Ratings) and Daniel Eskinazi (Soul Capital) discuss how Brazil’s structured debt market could provide a much needed alternative source of capital to corporates

16 Jul 2020

#BondsLoans24 - (in Spanish) Chile: Successfully issuing bonds to provide COVID-19 relief programmes

Patricio Sepulveda, Chile’s Head of Public Debt discusses his country’s response to the pandemic and their recent experiences successfully raise capital on the international markets

16 Jul 2020

#BondsLoans24 - (in Spanish) Paraguay: How COVID-19 will affect energy and infrastructure investment and policy for 2020/21?

Paraguay’s Minister of Finance, Benigno Lopez speaks to us about his country’s economic prospects, infrastructure developments, funding requirements and strategies to unlock investment

16 Jul 2020

#BondsLoans24 - Structured finance: Accessing capital where vanilla markets can’t provide it

Felipe Bomfim, Chief Financial Officer, Patria Infraestructura Carlos Linares, Chairman, COFIDE Juan Carlos Lorenzo, Head of Debt Capital Markets, Jefferies Moderated by: Kristie Pellecchia, Senior Advisor, Western Hemisphere, U.S. International Development Finance Corporation

16 Jul 2020

#BondsLoans24 - How is COVID-19 and the fall in oil prices impacting infrastructure deals in Latin America?

Jorge Camiña (Allianz Global Investors), Aurelio Bustilho de Oliveira (Enel), Eric Wittleder (Brookfield Asset Management), Leonardo Osorio (SMBC), and Adrian Garza (Moody’s Investor Service) discuss how infrastructure in Latin America will increasingly be financed by project finance loans and bonds

16 Jul 2020

#BondsLoans24 - What is the outlook for the privatisation programme, and investment in and out of Brazil in this new environment?

Rodrigo Tiraboschi (Privatisation Secretariat, Republic of Brazil) and Martha Seillier (Special Secretariat of the Investment Partnerships Program, Republic of Brazil) present plans for upcoming privatisations

16 Jul 2020

#BondsLoans24 - Brazil: How does the government plan to navigate its way back towards its economic vision

Luis Felipe Vital, Head of Public Debt at Brazil’s National Treasury speaks to Alexei Remizov (HSBC) about how his country is navigating its way back towards economic growth, and their recent experiences raising capital on international markets

16 Jul 2020

The 'Battle' For South Africa

The looming contest over South Africa’s political direction will kick off with a dispute over IMF financial support to plug a massive gap in government revenues. Opponents of IMF conditionalities favour tapping into state pension funds or stepping up central bank bond buying to make up the shortfall. With ‘battle’ lines drawn across the ruling alliance’s ideological divisions, the outcome of the…

17 Jun 2020

OPEC+ Production Cuts Will Place Additional Strain on Nigeria’s Economy

Adhering to the recently agreed OPEC+ oil production cuts will only deepen Nigeria’s economic problems and exacerbate its difficulties with external finances, according to a recent report by Fitch Ratings. Whilst liquidity provided by multilaterals will help ease some pressures in the short-term, macroeconomic strains will continue.

20 May 2020

Emerging Economies to see Boom in Off-Grid Renewables – Wood Mackenzie

Enormous strides have been made towards developing effective and affordable ways of generating power over the past decade, with technological innovation enhancing the viability of off-grid solutions. For emerging economies, a boom in off-grid energy will likely enhance access to swathes of the population, argues Wood Mackenzie. For state utilities, however, off-grid solutions could be…

18 Mar 2020

Debt Capital Markets Are Crucial to Success of Saudi Vision 2030, but Some Bankers Say it's Underutilised

Vision 2030, Saudi Arabia’s ambitious plan to transform the economy and diversify away from oil production, has seen the country develop the largest project pipeline in the region. But the government’s apparent reluctance to raise funds through the debt capital markets risks undermining Vision 2030, according senior investment bankers based in the region.

18 Mar 2020

CASE STUDY: Taweelah Green Loan Underpins Largest Reverse-Osmosis Water Desalination Project in the World

The USD758mn non-recourse project finance facility raised by Saudi-based ACWA Power, a rare green loan from the Middle East, will fund the construction of the Taweelah IWP in Abu Dhabi, which will be the world’s largest reverse-osmosis desalination plant upon completion in 2022.

12 Mar 2020